Why You Should Write a Newsletter for Investors (and How to Nail It)

Full guide to write your startups investor newsletter

Hey everybody welcome back to the Product Market Fit Newsletter 🚀

In this article I’m going to talk about:

Why you should write an Investor Newsletter

How best founders do it

What Information to Include

Premium: Investor Newsletter Template 💸

Let’s get to it!

Still a free subscriber? Upgrading to a premium subscription will give you access not only to these invaluable post but also to the entire archive of articles published on Product Market Fit. You'll gain insights, resources, and strategies that have already helped hundreds of founders

1. Why You Should Write an Investor Newsletter

Investor updates can be your secret weapon.

They keep your investors engaged, informed, and excited about your journey—and they might just save your startup in crunch time.

What the investor newsletter can do for you:

Stay Top of Mind: You want investors thinking about you when opportunity knocks. An intro to a key hire or customer? Yes, please.

Show Your Wins: Show off your progress—investors love seeing growth. It validates their decision to back you.

Build trust: Transparency builds trust. They can’t help you if they don’t know what’s up.

Make Them Advocates: A well-informed investor is way more likely to hype you up to their network.

2. How the Best Founders Do It

Be Regular (but not boring): Monthly or quarterly updates, no exceptions.

Numbers Talk: Share the metrics that matter—revenue, burn, runway, growth.

Celebrate Wins: New customers, product launches, team hires? Tell them.

Own Your Challenges: Be honest, but also show your plan to fix stuff.

Ask for Help: Introductions, feedback, anything you need. Investors love being useful.

3. What Information to Include in Your Investor Newsletter (Point by Point)

Here’s exactly what you should include in your investor newsletter and why each piece is critical:

1. Greeting and Intro

What to Include: A friendly opening that sets the tone for the newsletter.

Why It Matters: It’s an opportunity to remind investors you value their support and set the stage for the rest of the update.

Example:

“Hi [Investor Name], I hope you’re doing great! It’s been an exciting month at [Your Startup Name]. Here’s a quick look at our wins, challenges, and how you can help us push forward.”

2. Highlights (Wins)

What to Include: Key achievements since the last update:

Revenue growth (e.g., hitting new MRR/ARR milestones)

Big customer wins (especially notable brands or large deals)

Product/feature launches

Team updates (e.g., major hires, promotions)

Why It Matters: Wins build confidence and reinforce why they invested in you. Quantify progress wherever possible.

Example:

“This month, we closed our largest customer deal to date—[Customer Name]. Revenue grew by 20%, and we launched [Feature Name], which increased user engagement by 30%.”

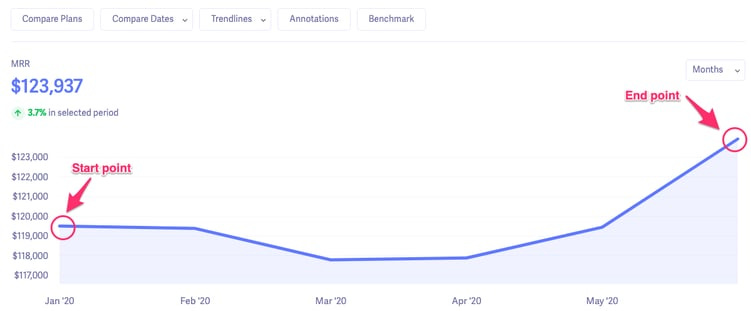

3. Metrics That Matter

What to Include: 3-5 core metrics that show the health of your business:

Revenue (MRR/ARR)

Burn rate and cash runway

Churn/retention rate

Customer Acquisition Cost (CAC)

Other KPIs relevant to your business (e.g., active users, LTV)

Why It Matters: Investors are data-driven and need to track your progress over time. Consistency in the metrics you report builds trust and transparency.

Example:

MRR: $120K (+15% MoM)

Burn Rate: $45K/month

Runway: 14 months

Churn Rate: 5%

4. Lowlights (Challenges)

What to Include: Challenges or areas where you’re falling short, along with your plan to address them:

Missed targets

Product delays

Hiring struggles

Why It Matters: Being honest about challenges shows maturity and builds trust. Investors can’t help you if they don’t know what’s going wrong.

Example:

“We’re struggling to find a senior sales lead. We’ve expanded the search to new job boards and are offering a referral bonus. If you know someone, please let us know.”

5. Asks (How They Can Help)

What to Include: Specific, actionable requests for your investors:

Introductions to potential customers, partners, or other investors

Help filling open roles

Feedback on strategy or product

Why It Matters: Your investors want to help, but you need to make it easy and clear. The more specific you are, the more likely they’ll step in.

Example:

“We’re looking for intros to VPs of Sales in the SaaS space.”

“We’re hiring a Senior Engineer with experience in AI/ML—any referrals would be great!”

6. Financial Snapshot

What to Include: A summary of your financial position:

Cash on hand

Monthly expenses

Burn rate

Runway

Why It Matters: This gives investors visibility into how well you’re managing their money and ensures there are no surprises down the road.

Example:

Cash Balance: $900K

Burn Rate: $50K/month

Runway: 18 months

7. Upcoming Milestones (What’s Next)

What to Include: Goals and priorities for the next period:

Product launches

Sales/market expansion

Fundraising plans

Why It Matters: It keeps investors aligned with your vision and progress while signaling where their help could make the most impact.

Example:

“Next month, we’re launching [Feature Name], doubling down on sales outreach in [Region], and kicking off our Series A fundraising efforts.”

8. Closing Statement

What to Include: A thank-you and invitation for feedback or questions.

Why It Matters: Ending on a positive, grateful note reinforces your relationship and keeps the communication open.

Example:

“Thank you for your continued support—it makes all the difference. Feel free to reply with any thoughts or questions, and let’s keep building something amazing together!”

9. Attachments or Links

What to Include: Supplemental materials as needed:

Pitch deck or fundraising materials (if applicable)

Job postings for open roles

Customer case studies or testimonials

Why It Matters: Additional context or resources make it easier for investors to take action on your asks.

Key Tips

Keep it short (1 page max).

Use clear sections and bullet points for easy reading.

Add visuals (charts, graphs) for metrics when possible.

Send it on a consistent schedule (monthly or quarterly).

Premium! Your Investor Newsletter Template 👇

Still a free subscriber? Upgrading to a premium subscription will give you access not only to this invaluable resource but also to the entire archive of articles published on Product Market Fit. You'll gain insights, resources, and strategies that have already helped hundreds of founders