Why VCs Say 'No' to Seed Rounds—And How 10 B2B SaaS Founders Turned Rejection into Success

Hey everybody welcome back to the Product Market Fit Newsletter 🚀

My name is Guillermo Flor and I write this weekly newsletter to help founders, growth professionals and product people to grow & fund their companies.

On this article I’m going to talk about the main problems founders encounter when trying to raise a round and how best entrepreneurs solve them as well as how it looks form the investor POV.

But, before going for it, hit play and enjoy these beats

So, in today newsletter I’m going to discuss two things that I find so relevant for founders which are:

Self limiting beliefs that prevent founders from raising capital (and how to overcome them)

PREMIUM: Why VCs Say 'No' to Seed Rounds—And How 10 B2B SaaS Founders Turned Rejection into Success

Enjoy 🤙

There’s isn’t suficcient talk about how building a successful startup is more about overcoming constant obstacles than anything else.

And the main difference between the successful founders and the ones that fail is that the first ones learn to take every no as a problem to solve and the sencond ones allow a no at some point to kill their startup.

With fundraising is the same, and I see some many founders think…

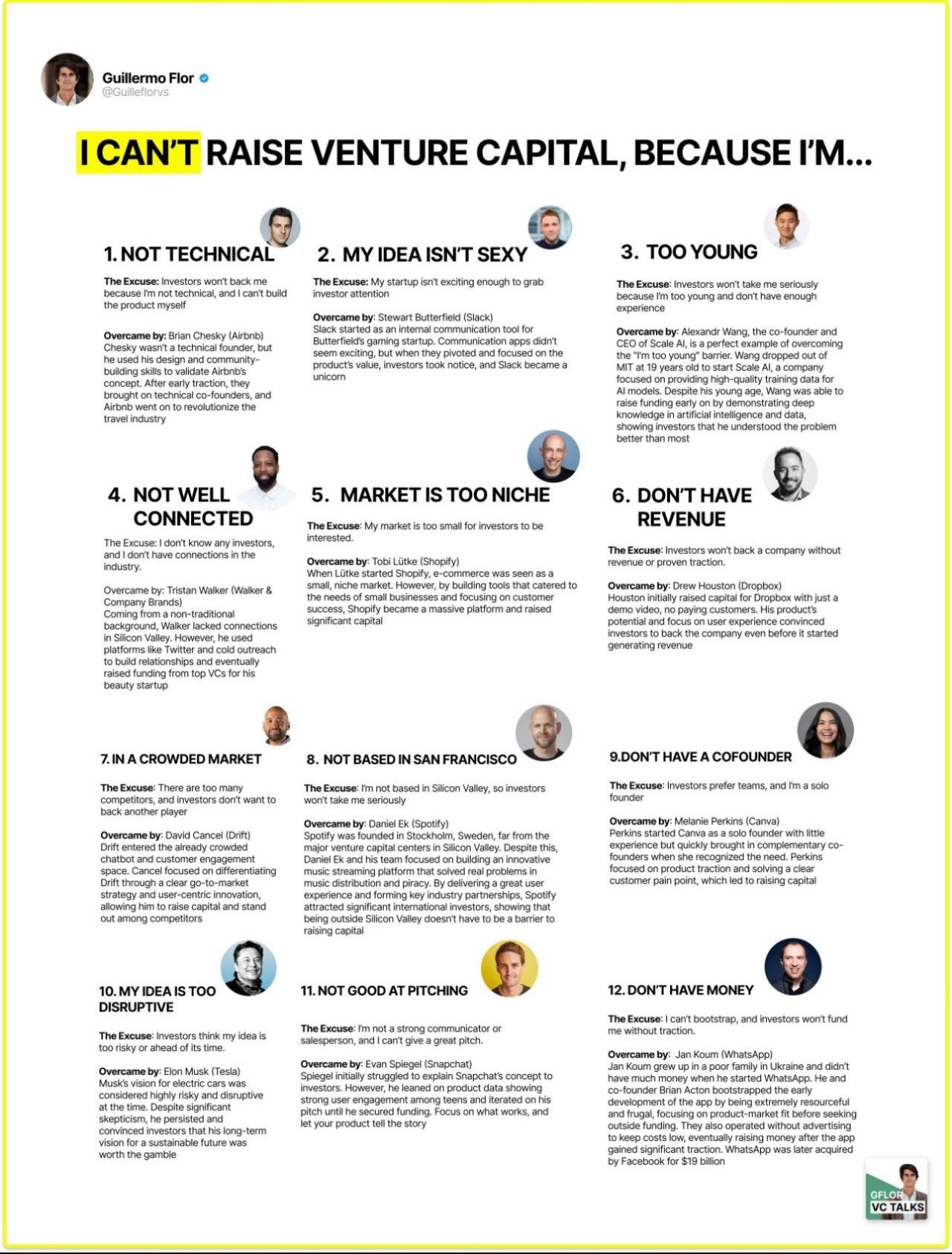

I Can't Raise Venture Capital Because I'm...

1. No Technical Background

Problem: Investors may prefer technical founders who can oversee product development.

Solution: Highlight your strengths (e.g., design, business strategy) and build a technical team.

Example: Brian Chesky of Airbnb, a designer, collaborated with tech experts to grow Airbnb.

2. Unexciting Idea

Problem: Investors are drawn to trendy ideas, so a “boring” concept might struggle to attract attention.

Solution: Show traction and customer need.

Example: Stewart Butterfield’s Slack, initially a simple communication tool, became a leader by proving its value in a crowded space.

3. Too Young or Inexperienced

Problem: Youth and inexperience can lead to doubts about leadership capabilities.

Solution: Demonstrate passion and seek mentors.

Example: Mark Zuckerberg focused on user growth and adapted quickly, convincing investors to back Facebook.

4. Limited Network

Problem: A small network can limit investor connections.

Solution: Network actively through events and social media.

Example: Tristan Walker leveraged social media to connect with top VCs.

5. Niche Market

Problem: Small markets may seem less attractive due to limited growth potential.

Solution: Show the potential for growth or expansion.

Example: Tobi Lütke’s Shopify, originally for small businesses, expanded into a global e-commerce giant.

6. No Revenue

Problem: Pre-revenue startups can seem risky without validation.

Solution: Showcase user engagement or waitlists.

Example: Drew Houston used a demo video for Dropbox to secure funding pre-revenue.

7. Crowded Market

Problem: Competing in a saturated market may concern investors about differentiation.

Solution: Emphasize your unique value proposition.

Example: David Cancel’s Drift stood out by focusing on conversational marketing.

8. Location Outside Major Tech Hubs

Problem: Investors might prefer startups in tech hubs for proximity.

Solution: Highlight location benefits like lower costs.

Example: Ben Chestnut grew Mailchimp from Atlanta by focusing on customer needs.

9. Solo Founder

Problem: Investors prefer teams over solo founders for diverse expertise.

Solution: Bring on advisors or key hires.

Example: Melanie Perkins added co-founders to Canva, strengthening her team and raising capital.

10. Disruptive Idea

Problem: Highly disruptive ideas can seem risky due to industry challenges.

Solution: Outline clear implementation steps and risk mitigation.

Example: Elon Musk’s Tesla attracted investors by proving demand for electric vehicles.

11. Lack of Business Experience

Problem: Investors might doubt your ability to commercialize the product.

Solution: Focus on product-market fit and surround yourself with skilled business professionals.

Example: Patrick Collison’s Stripe succeeded by prioritizing user experience.

12. Only an MVP

Problem: MVPs may not demonstrate enough traction or scalability.

Solution: Use the MVP to gather feedback and outline your growth plan.

Example: Alexis Ohanian’s Reddit attracted investment with a basic MVP by showing community growth.

13. Too Early Stage

Problem: Early-stage startups may struggle without customers or revenue.

Solution: Seek early-stage investors or accelerators.

Example: Y Combinator supports startups at the idea stage, helping them build and validate ideas.

14. Weak Pitching Skills

Problem: A poor pitch can fail to convey your vision.

Solution: Refine your pitch with clarity and storytelling.

Example: Evan Spiegel emphasized Snapchat’s user engagement, winning investors over.