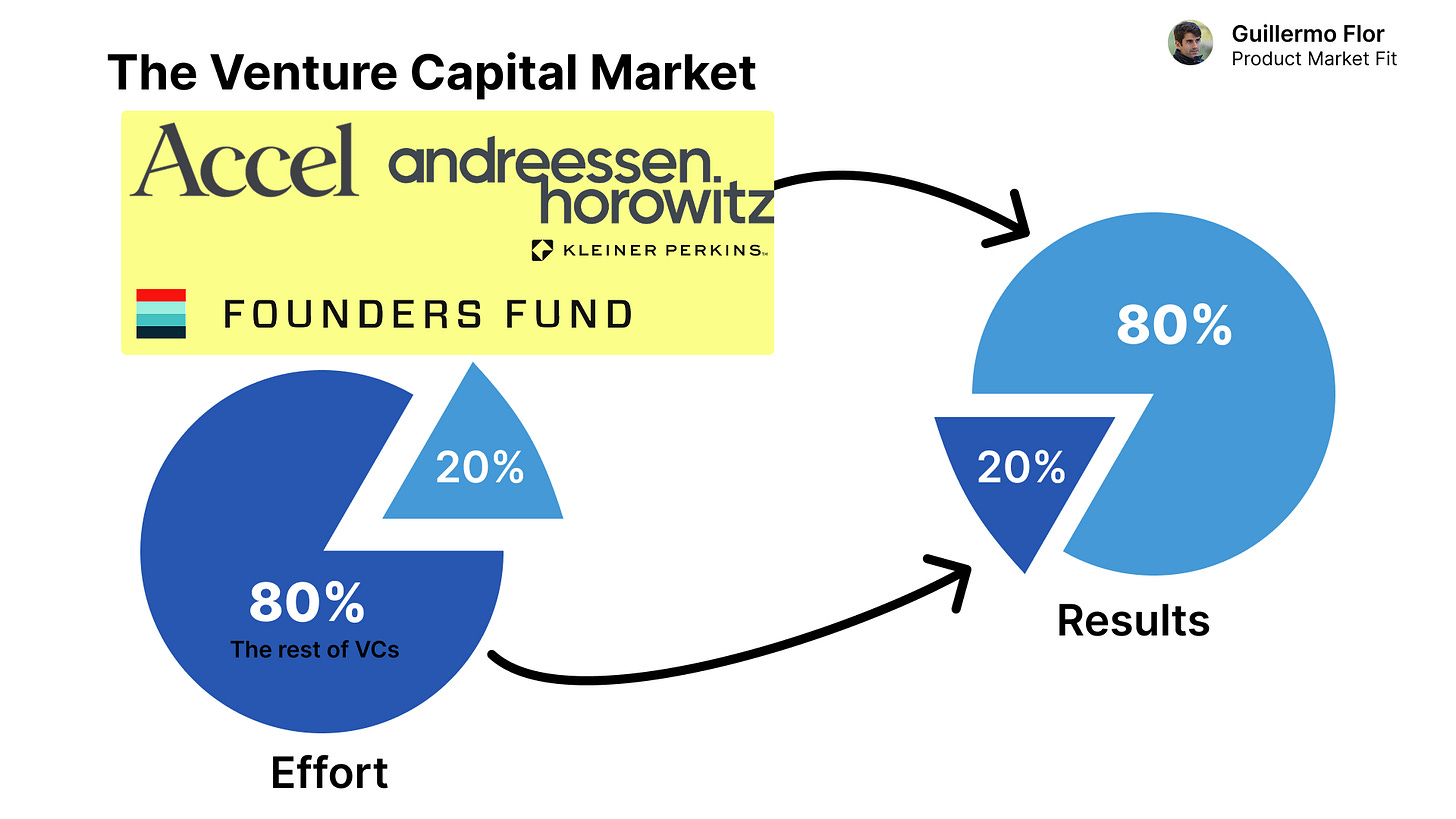

The top 20 firms (out of approximately 1,000 total VC firms) generate approximately 95% of the Venture Capital industry’s returns.

Every year, about 15 truly great companies are born.

Companies that will define markets, reshape industries, and create billions in value.

And around them, thousands of VCs compete to get in.

But only a handful will win.

Welcome to PMF, the home to +50K founders & investors worldwide. Here we share the top resources & knowlege to build generational companies. Sponsor it at g@guillermoflor.com & be together with brands like Replit, Figma, Framer & more

Venture capital looks like a market full of opportunity, but it’s not.

It’s a game of access.

Every year, thousands of funds fight to back the same few companies. Most of them never even get close.

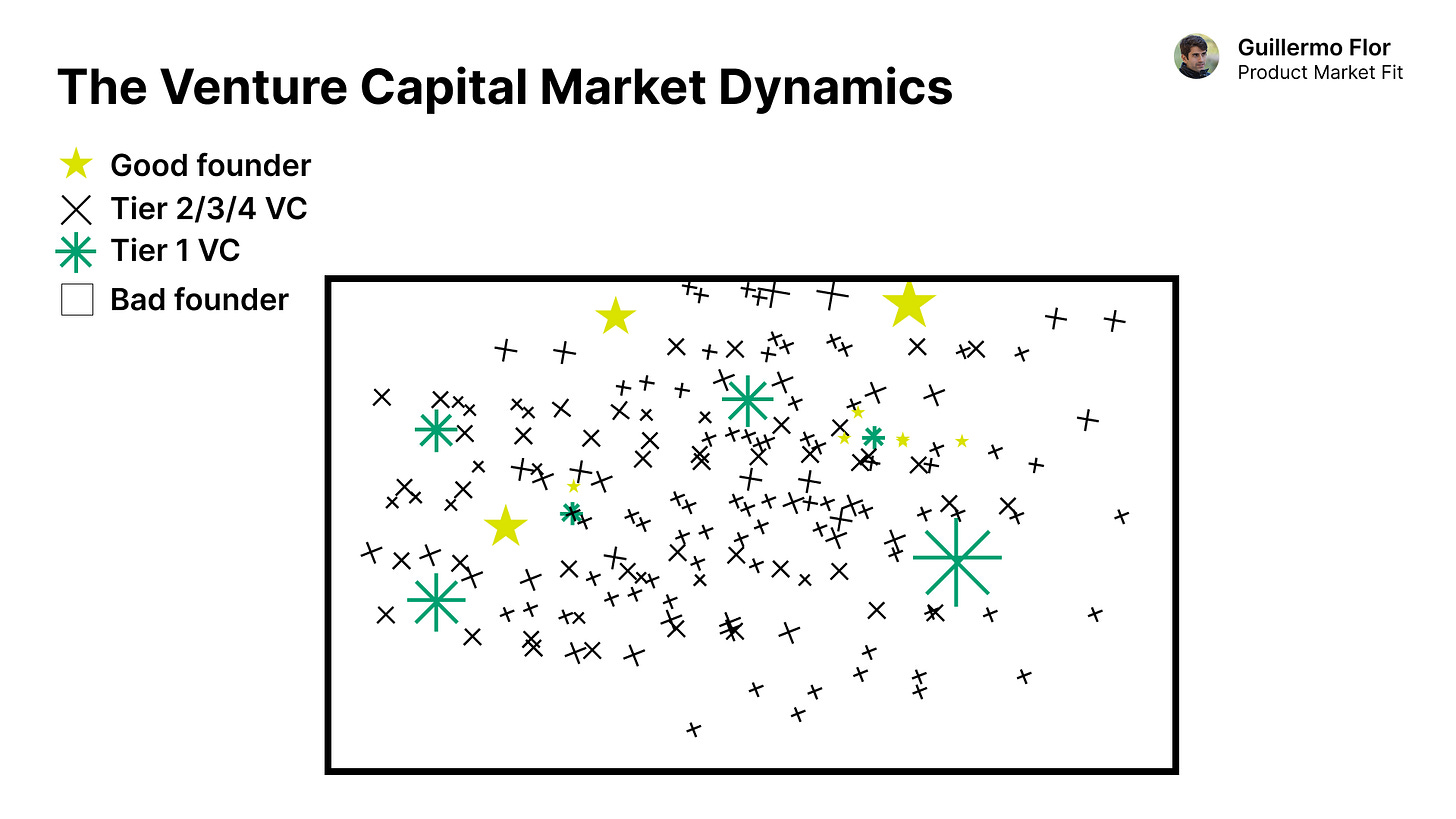

At the earliest stages, anyone can meet founders. But once a startup shows real signs of being special, everyone notices. Revenue traction, product velocity, or a strong founding team — the signal spreads fast.

Suddenly, the same 15 or 20 firms are competing to invest. The difference is that Tier 1 firms don’t really need to compete. They have the brand, the capital, and the reputation that founders already want.

That’s how venture works in reality.

Founders are the ones deciding who to work with, not the other way around.

So when a breakout founder starts raising, they’ll have a long list of offers — but the names at the top are always the same: Sequoia, Andreessen Horowitz, Benchmark, Index, Lightspeed, Accel.

They choose them because raising from a top firm is a signal. It helps them hire better talent, close customers faster, and attract stronger future investors.

Tier 2 and Tier 3 firms simply can’t offer that. They might be great investors, but they don’t have brand gravity.

Even if they invest in a good company early, it’s nearly impossible to repeat. Because they don’t control the next rounds, and they can’t follow on with larger checks.

Meanwhile, Tier 1 firms manage billions. They can write a $20M check at Series A, $50M at Series B, $100M at Series C. Their multiple might be smaller, but they make it up with scale. That’s how they compound.

This creates a feedback loop where the same few funds keep winning.

They get the best deals because they’ve already won before.

And that reputation keeps growing.

The rest of the market fights for scraps — hoping to find one undiscovered gem that the top firms missed. But in today’s world, information spreads too fast. If a company is truly great, everyone knows it in days.

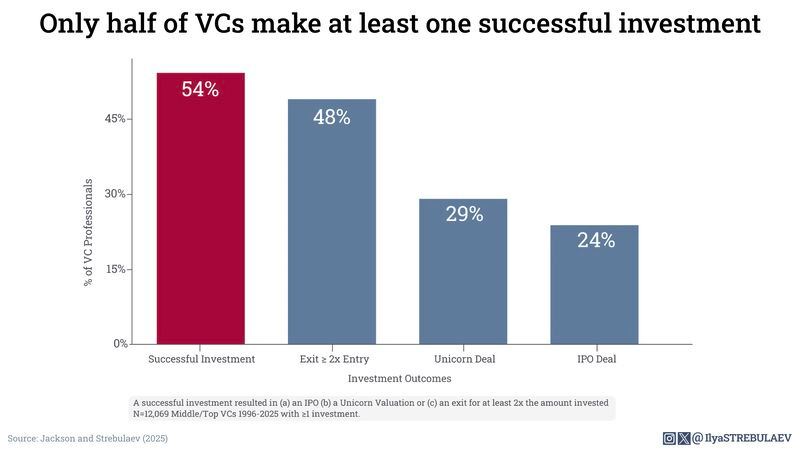

That’s why most VCs can’t generate real returns.

The market has become too concentrated, too global, and too competitive for small funds to stand out.

Example: every VC in Europe (and the world) wanted to invest in Lovable. They chose Accel to lead the round.