Venture Capital is Dead

Why Lightspeed, a16z & co are buying, rolling up, and building like operators

Hey everybody! Welcome back to the newsletter!

My name is Guillermo Flor and I’m an entrepreneur turned Venture Capitalist

Remember to subscribe and share if you found it valuable!

The Venture Capital industry is changing forever. High valuations, low liquidity and AI is changing everything, and the Tier 1 VCs know it and are adapting to it.

VC as we know it is dead.

Is Venture Capital Dead?

Pitchbook recently released their US Venture Captial Ecosystem review and the metrics confirm the highly complex market situatio VC is living at the moment.

Now, what’s going on?

Venture Capital has got as competitive as ever due to the high amounts of funding raised since 2019 that inflated the market and the startup valuations.

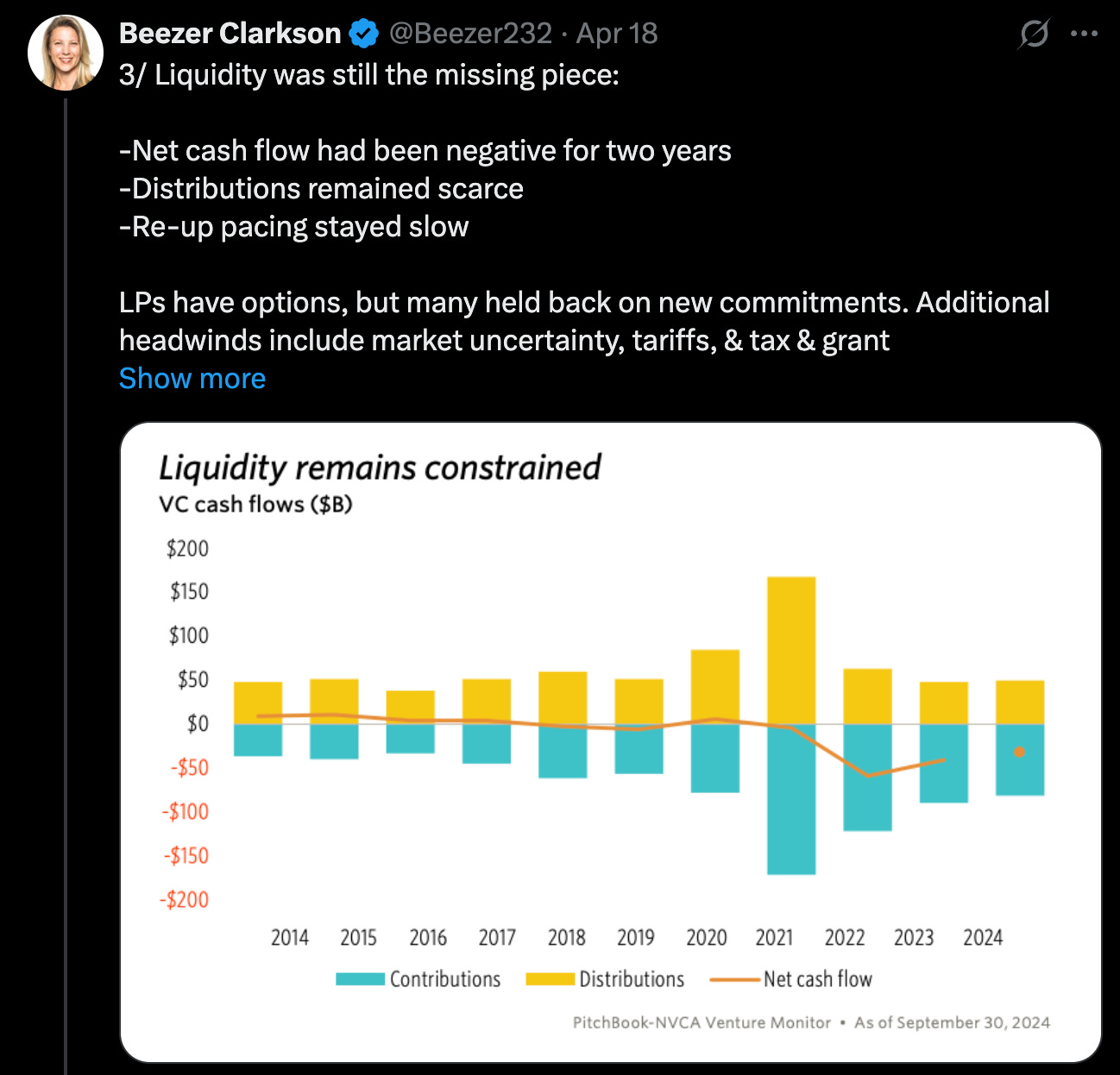

There’s still so much dry powder in the market and together with the AI feverr, valuations are still highter than ever but funds are seeing very few exits and little liquidity.

This is obviously making it harder for new managers or managers without amazing returns to fundraise with LPs losing their appetite for high risk low potential investments.

There probably will be a big consolidation into big funds that have access to the best founders and best deals.

Alternative solutions? Investing temporily in other asset classes

That’s exactly what some top-tier VC firms are doing.

Lightspeed, Thrive, a16z, Sequoia.

They’re not just waiting around for IPOs.

They’re acting like Private Equity firms — launching, acquiring, and rolling up companies.

Venture Capital is starting to look a lot like Private Equity.

Lightspeed: the turning point

Lightspeed Venture Partners just became a Registered Investment Advisor (RIA).

This isn’t just a legal formality.

It’s a massive shift in how they can operate.

As an RIA, they can now:

Buy public stocks

Invest freely in secondary shares

Do buyouts

Build roll-up strategies

And they’re not alone.

a16z made the RIA move back in 2019. Since then, they’ve launched a wealth management arm, jumped into the Twitter buyout, built a massive crypto operation, and started behaving more like a governance-heavy PE firm than a typical VC.

Sequoia killed the classic fund structure and moved to a single evergreen vehicle — no more 10-year cycles, just long-term bets and flexibility.

General Catalyst? They stopped calling themselves a VC firm altogether. They bought a hospital system, started building AI companies in-house, added a wealth division… and now they go by “Transformation Company.”

Thrive Capital launched Thrive Holdings, a $1B vehicle to buy and build AI-first companies. Not just investing — operating.

So… what do you do with this information?

This isn’t just an industry trend.

It’s an opening.

If VC is turning into PE, and top firms are evolving into operating platforms — there’s room to build around that.

Here’s where the opportunities are:

Hey everyone! The content below is premium access only! If you want to check it out subscribe or access the free trial below!