The Ultimate Investor List of Lists

8 premium investor databases (6,600+ entries): 1,000 family offices, 1,000 top angels, AI unicorn angels (Lovable, Cursor, Mercor, Polymarket, Synthesia, ElevenLabs), 160+ investors who fund cold outr

Fundraising isn’t hard because “there aren’t enough investors.”

It’s hard because you don’t have a clean system to answer:

Who exactly should I contact?

How do I reach them directly?

Which ones match my stage + geography + sector?

So over the last 3 years I’ve curated what I wish every founder had on day one:

The Ultimate Investor List of Lists: 8 investor databases (6,600+ entries) built to help you build a pipeline fast.

What you get inside

What’s included:

💰 1,000 Family Offices investing in startups

💰 1,000 Most Active Angel Investors

💰 AI Unicorn Angels (Lovable, Cursor, Mercor, Polymarket, Synthesia, ElevenLabs)

💰 160+ No-Warm-Intro-Required Investors (checks from cold emails/DMs)

💰 300 Most Active Seed VCs worldwide

🗽 1,000 Corporate VC funds

🏛️ 3,000 LPs (HNWI → institutions)

🟧 Top 150 accelerators/incubators/micro-VCs

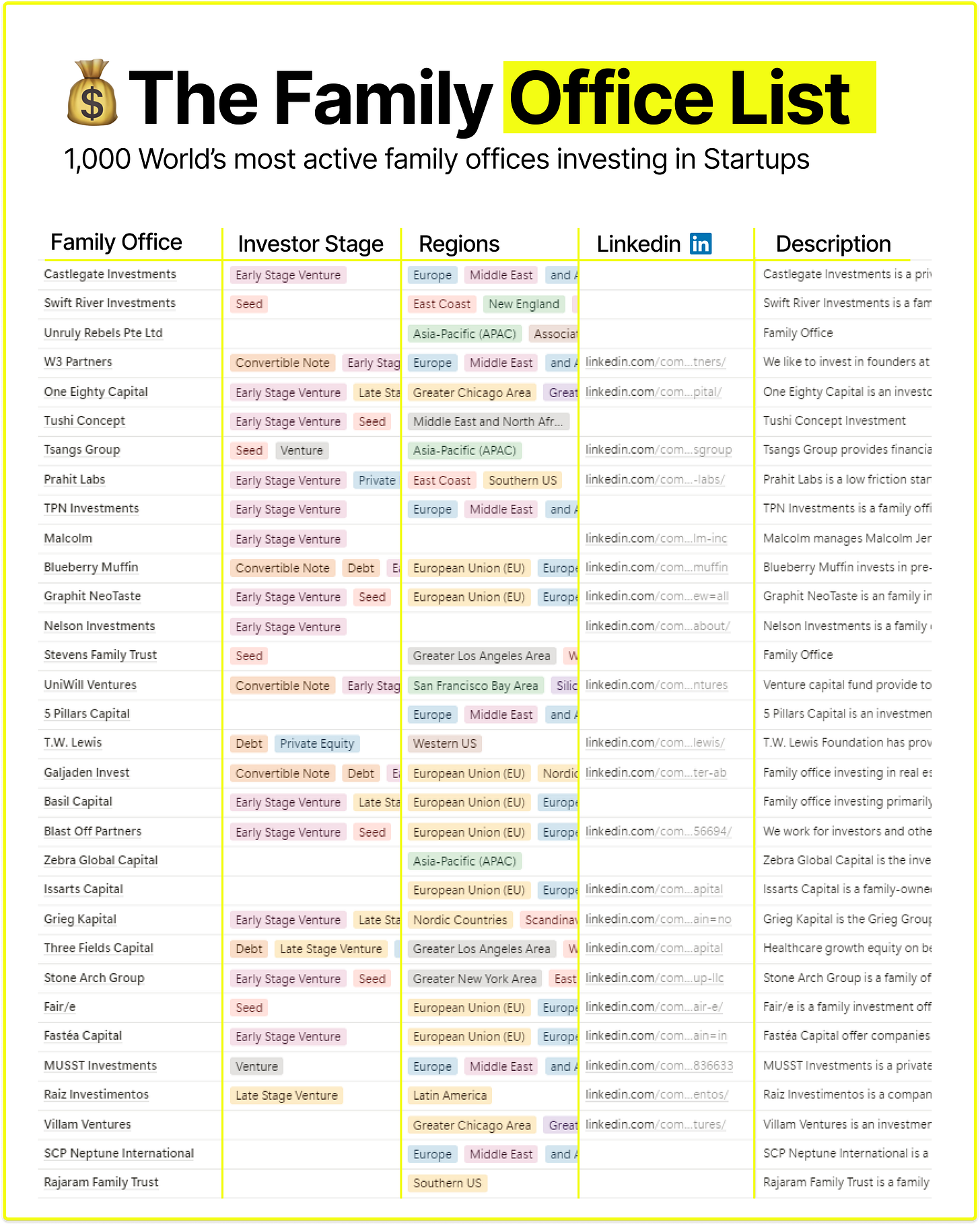

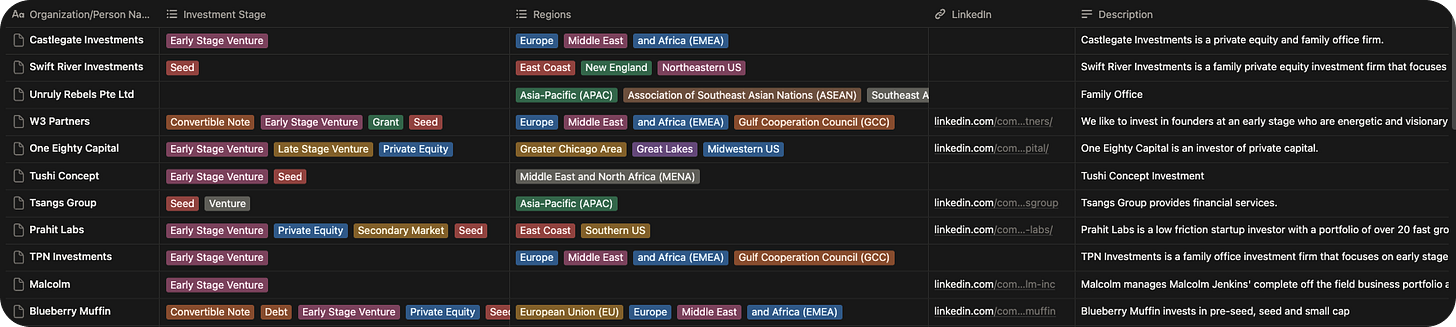

1. The Family Office List

A curated list of 1,000 active family offices investing in startups worldwide, including investment details, preferred stages, regions, and direct contact links.

Best for: bigger pre-seed/seed rounds, strategic capital, long-term holders.

2. The Angel Investor List

1,000 of the world’s most active angel investors.

Includes investor type, stages, regions, and direct profiles so you can reach out fast.

Best for: pre-seed and seed, fast checks, fast decisions.

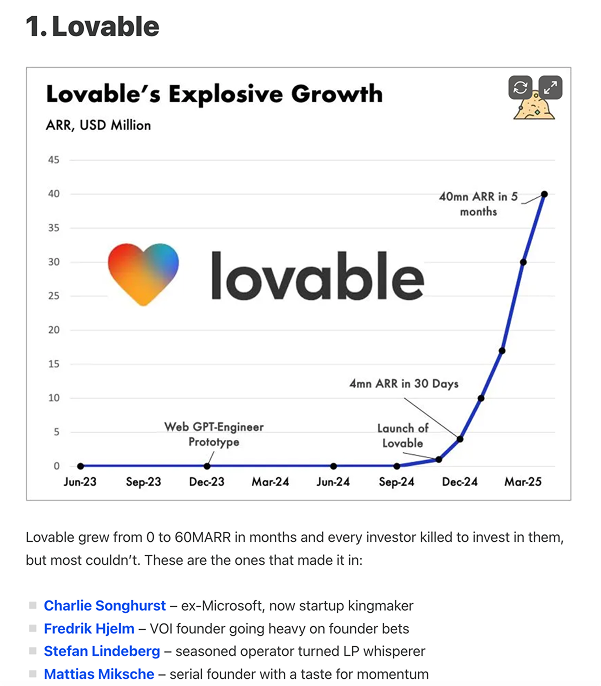

3. The AI Unicorn Angel List

Angels who backed Lovable, Cursor, Mercor, Polymarket, Synthesia & ElevenLabs (the people who consistently see the best deals early).

Best for: AI founders who want investors that “get it” instantly.

4. 💰 The No-Warm-Intro-Required Investor List

160+ investors who have actually written checks to founders who DM’d, cold-emailed, or pitched without an intro.

Best for: anyone without a strong VC network (or who wants speed).

5. 💰 The 300 Most Active Seed VC Investors 🌍

The ultimate list of the most active early-stage VCs worldwide, featuring fund names, websites, LinkedIn and Twitter profiles, focus, stages, and number of investments.

Best for: seed rounds, repeatable outreach, building a real pipeline.

🗽 The Corporate Venture Capital Fund List

A curated list of 1,000 global CVC funds, with stages, regions, LinkedIn profiles, and insider details.

Best for: strategic distribution, partnerships, credibility, enterprise GTM.

6. 🏛️ The LP Investor Database

3,000 LP investors (HNWI to funds of funds and institutions).

Best for: fund managers, SPVs, syndicates, scouts building their LP base.

7. The World’s Top Accelerator Programs List

The world’s top 150 accelerators, incubators, and micro-VCs, including funding types, locations, and contact info.

Best for: structured fundraising, accelerators, early validation, intros.

What the lists include

Across the lists you’ll find (depending on the database):

Investor / fund name

Investor type (angel, family office, VC, CVC, LP, accelerator)

Investment stage (pre-seed, seed, Series A…)

Geography / regions

Sector focus / keywords

Websites

LinkedIn profiles (direct links)

Twitter/X profiles (when relevant)

Investment activity (e.g., number of investments, recency signals when available)

Extra notes that matter for targeting (preferences, context, positioning)

The goal: you can filter, shortlist, and contact people in minutes.