The Revolut Investors Who Won Big: Balderton’s Billions, Crowdcube’s Millionaires, and the Secret Angel List

Balderton turned £1.5M into billions, Crowdcube minted hundreds of unexpected millionaires, and a secret list of angels got rich beyond belief — our Excel model shows exactly how they did it

Hey everybody welcome to PMF!

First, I wanted to share that the PMF Growth whatsapp group is live! If you think you should be in it and didn’t receive an invite let me know!

Some behind the scenes 👀

Now, let’s talk about what we came here for.

Revolut shared on Monday it had completed a secondary share sale valuing it at $75 billion, a 66% jump from last year and underlining the rapid growth of Europe’s most valuable financial technology company.

So I thought it would be very interesting go a bit into details of Revolut’s equity & funding story and the most successful investors in the company (focusing more on individual investors- angels).

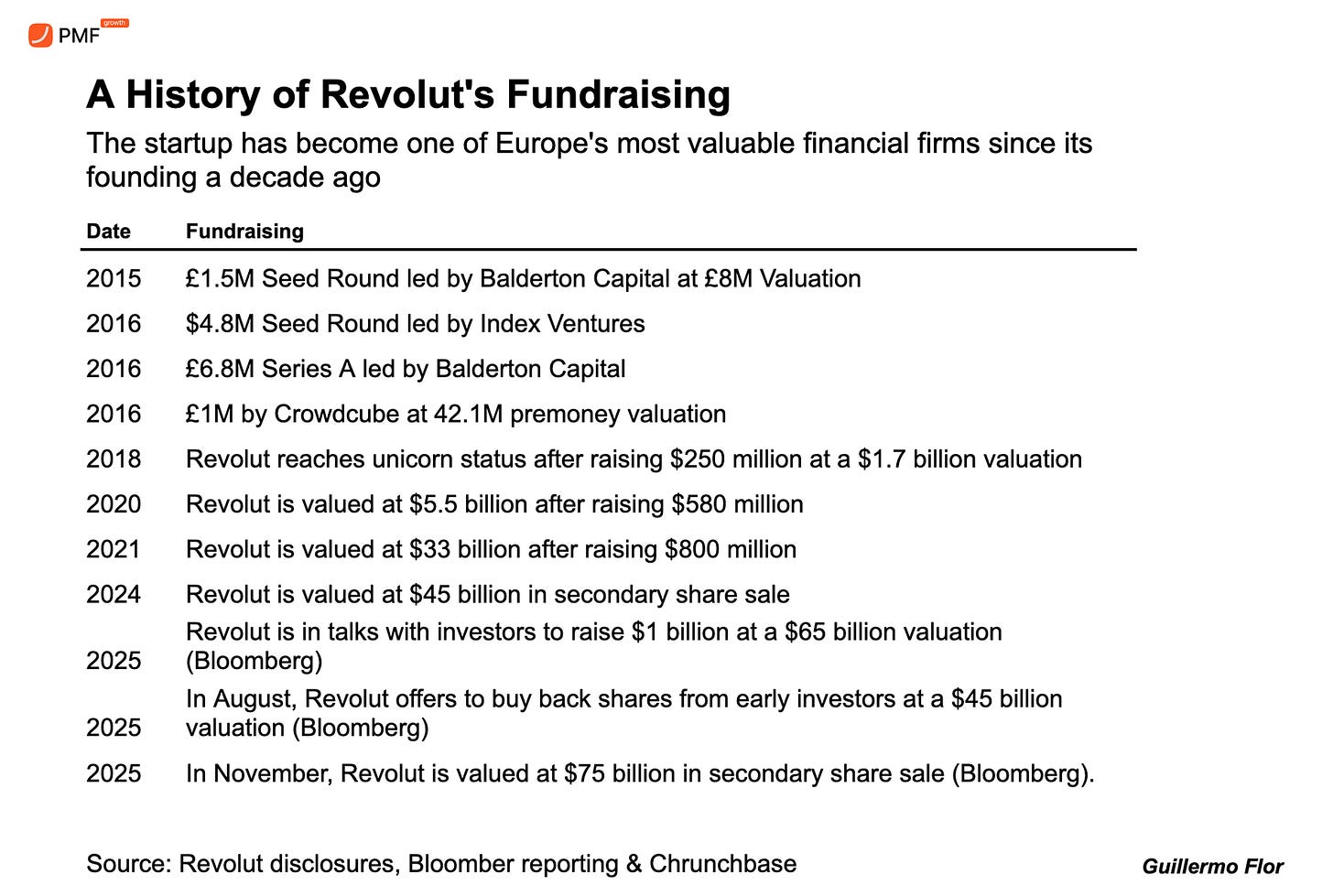

So, first a quick overview of Revolut’s funding & valuation story.

For premium subscribers:

Access our Excel Model of Balderton & Crowdcube returns

Revolut’s most successful Angel Investors & linkedin profiles (many keep investing)

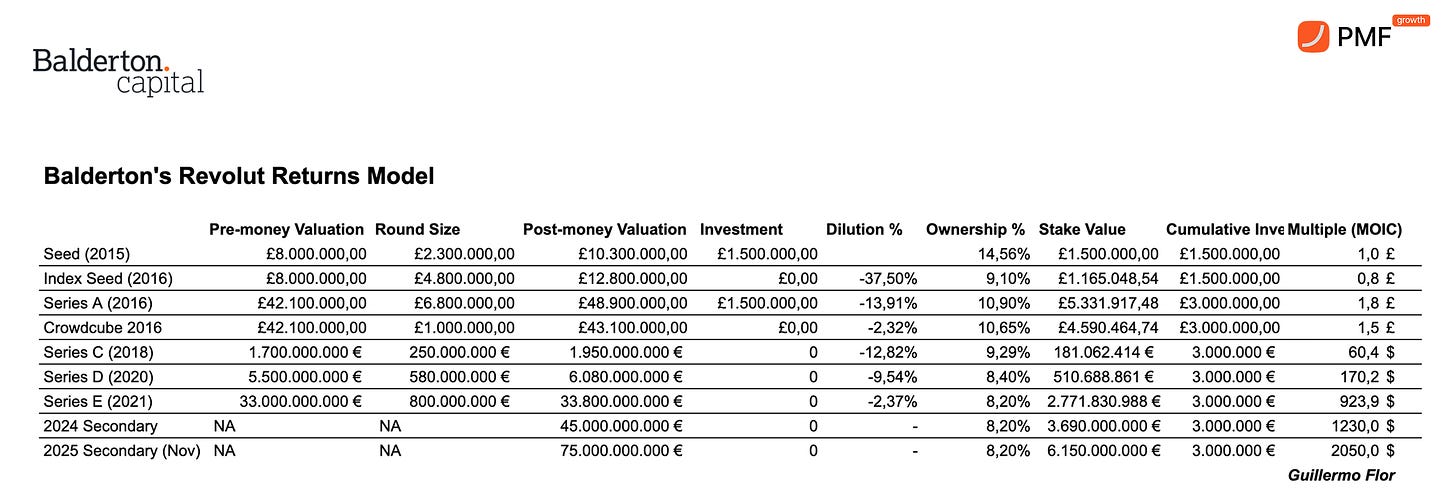

1. How Balderton turned a 1.5M check into +4Billion

The first institutional investors were SeedCamp and Balderton, that led Revolut’s seed round early on (at a 8M valuation). Balderton invested 1.5M in this round.

The returns for this investment are some of the best returns in Venture Capital ever.

Let’s break it down:

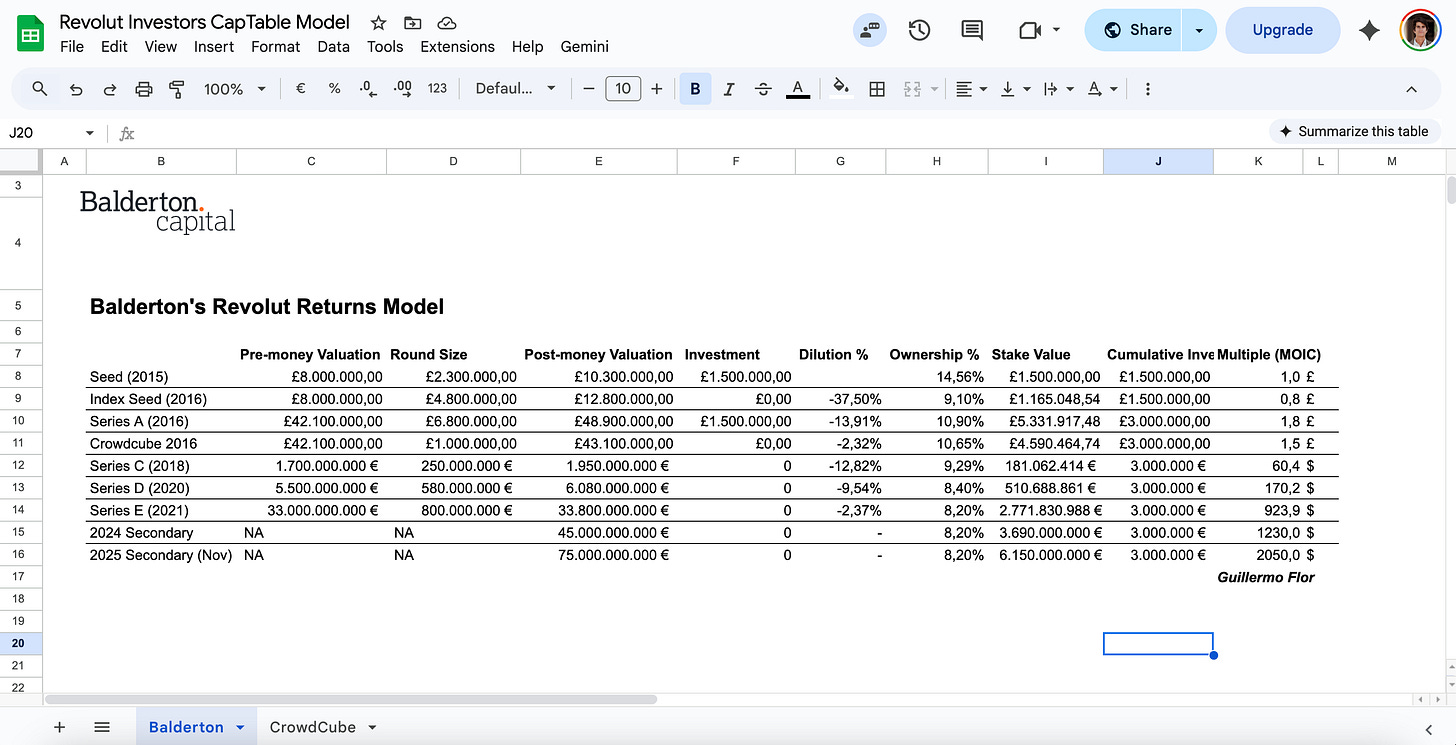

Balderton first invested £1.5M in Revolut in 2015, when the company was barely more than an idea and valued at just £8M. That early conviction gave them 14.56% of the entire company — an enormous ownership stake that would never be possible today. It was the kind of bet where the investor is essentially backing the founders and the vision, not a proven business.

One year later, Revolut raised a £4.8M seed round led by Index Ventures, which significantly diluted all early shareholders. Balderton’s ownership dropped from nearly 14.6% to about 9.1%. This is normal in the life of a fast-growing startup: every time new money comes in, early investors own a smaller slice. But the key is what happens next — whether the company actually grows enough to make the shrinking slice more valuable.

Soon after that, Balderton doubled down and led the Series A, reinforcing their conviction before Revolut had truly broken out. After dilution from that round, their stake settled around 10.9%, which is still a massive position for a fintech that was just beginning to grow. This moment is critical: most VCs hesitate at this stage, but Balderton leaned in again.

From there, Revolut took off. User growth and product expansion accelerated, and the company raised several huge rounds: $250M at a $1.95B valuation, then $580M at $6.08B, and finally $800M at a $33.8B valuation in 2021. Each round diluted Balderton a bit more — down to 9.29%, then 8.40%, then 8.20% — but the company’s value was increasing exponentially faster than their ownership was shrinking. This is the magic of venture investing: a smaller slice of a massive pie can be worth far more than a big slice of a tiny pie.

By the time Revolut hit a $33.8B valuation, Balderton’s 8.20% stake was suddenly worth over $2.77B. Their original £3.0M in total checks had turned into billions. Then, in 2024 and 2025, Revolut traded in the secondary market at $45B and eventually $75B. At the $75B level, Balderton’s stake is worth roughly $6.15B — turning a £3.0M investment into over $6B, or roughly a 2,050× return.

To put that into human terms: if someone had invested £1,000 on the same terms as Balderton, it would now be worth roughly £2,050,000.

And because of this one deal, Balderton’s £300M fund was returned more than 20 times over.

Revolut alone delivered over $6B in value, making Balderton’s Fund V one of the highest-performing VC funds in European history, directly comparable to the legendary U.S. funds that backed Twitter, Coinbase, or SpaceX at the earliest stages.

2. Seedcamp invested earlier than Balderton

But I coudn’t find the amount the invested or valuation (but you can more or less imagine). Pretty wild

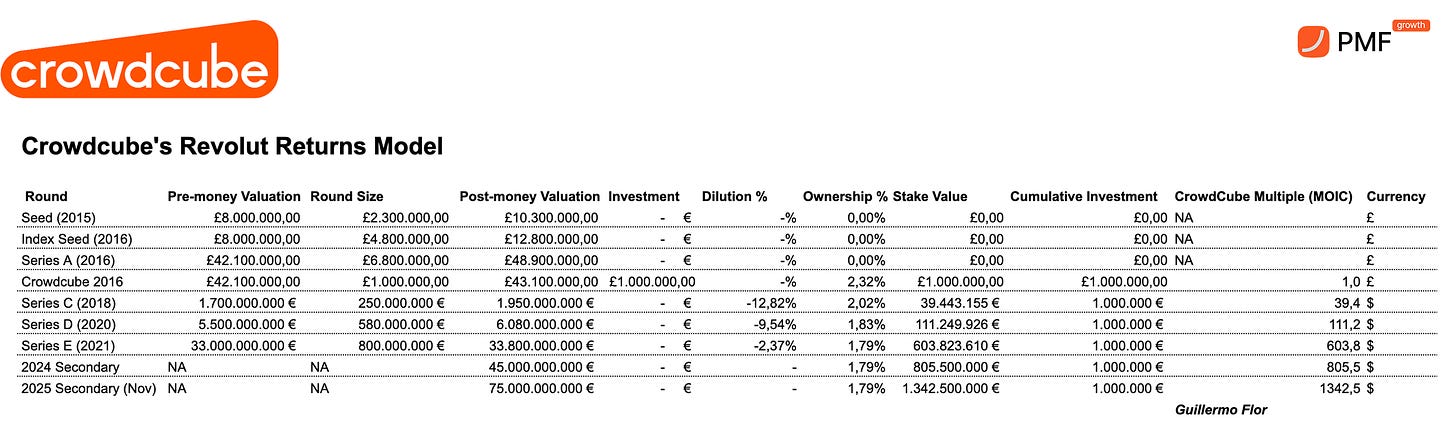

3. The Crowdcube Revolut Story: One of the Greatest Crowdfunding Wins Ever

Crowdcube investors entered Revolut in 2016, at a moment when the company was still early but no longer just an idea. The round took place at a £42.1M pre-money valuation ( £43.1M post-money ), with the Crowdcube syndicate investing a total of £1.0M. In exchange, retail investors collectively acquired approximately 2.32% of the company, a level of access that would be almost unimaginable today.

What made this round remarkable was not just the valuation, but who got to participate. At the time, Revolut was generating only £120k of revenue in 2015, was still finding its footing, and had not yet become the category-defining fintech it is today. Yet 433 individual investors decided to take a punt. The average cheque was £2,152, small in absolute terms, but placed at precisely the right moment in the company’s lifecycle.

Following the Crowdcube round, Revolut began to scale at extraordinary speed. In 2018, the company raised $250M at a ~$1.95B valuation, diluting Crowdcube’s collective stake from 2.32% to ~2.02%. Two years later, a $580M raise at ~$6.08B reduced it further to ~1.83%. In 2021, Revolut raised $800M at a ~$33.8B valuation, after which Crowdcube investors still owned approximately 1.79% of the company.

Despite steady dilution, value creation vastly outpaced ownership loss. By the $33.8B valuation in 2021, the Crowdcube stake was already worth over $600M, representing a ~600× return on the original capital. Subsequent secondary transactions simply re-priced that same ownership higher. At $45B in 2024, the stake was worth roughly $805M. By late 2025, when Revolut traded around a $75B valuation, the original £1.0M Crowdcube investment translated into approximately $1.34B of value, a ~1,340× multiple.

Put differently, the average £2,152 investment made by a retail investor through Crowdcube would now be worth ~£2.9 million, using the same multiple. A small, experimental cheque written before product-market fit, before scale, before global expansion, quietly turned into generational wealth.

Revolut became one of the most important companies in European fintech history. But it also became something else: one of the clearest demonstrations that, under the right conditions, retail investors can meaningfully participate in venture-scale outcomes. While institutional funds captured billions, Crowdcube proved that access, not just capital, is often the most underappreciated constraint in investing.

Premium Access:

Access our Excel Model of Balderton & Crowdcube returns

Revolut’s most successful Angel Investors & linkedin profiles (many keep investing)