The Investment Memo List

Behind 17 of World's most successful venture capital investments

Inside the Minds of Top VCs: 17 Investment Memos You Can’t Miss

Hey everyone, welcome back to the Product Market Fit Newsletter 🚀🚀

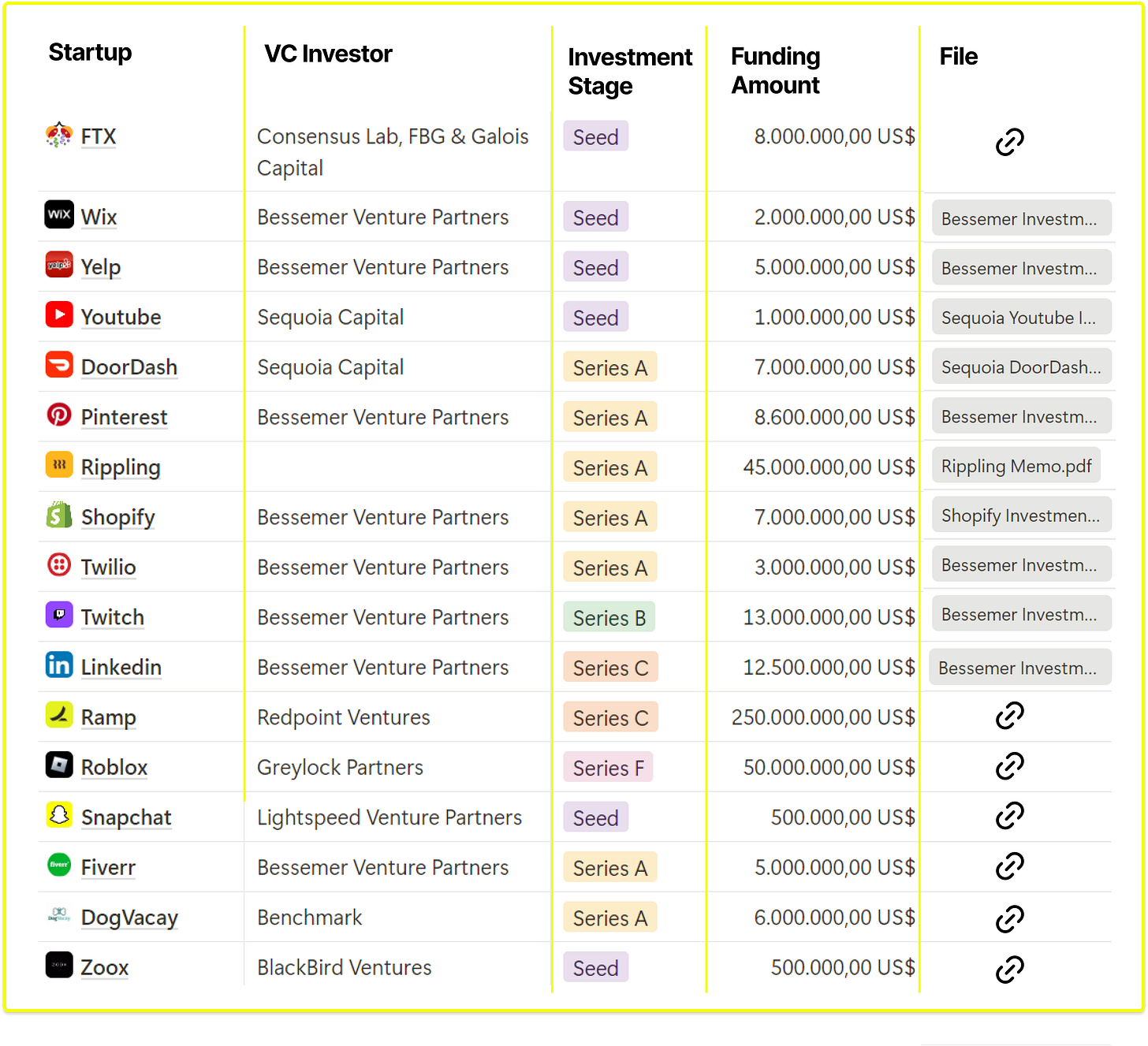

This week, I’m sharing something truly unique—a collection of 17 actual investment memos from some of the most legendary VC deals ever made.

These memos come from firms like Sequoia, Benchmark, Lightspeed, Bessemer, Blackbird, and Redpoint, and they break down why these firms bet big on companies that went on to redefine industries.

Here are just a few of the companies featured:

YouTube: How Sequoia identified the potential of a video-sharing platform before anyone else.

Pinterest: Benchmark’s take on the rise of social curation.

Shopify: Why Bessemer believed in empowering small businesses to build online stores.

DoorDash: Lightspeed’s vision for the future of food delivery.

Roblox: Insights into the gaming platform that became a metaverse pioneer.

Ramp: The story behind a corporate card redefining expense management.

Zoox: Blackbird’s early bet on autonomous driving.

And yes, even the controversial ones like FTX—because understanding what went wrong is just as valuable.

Why This Collection Matters

1️⃣ Learn How VCs Spot Winners: These memos show the data, market insights, and founder qualities that stood out.

2️⃣ Elevate Your Fundraising: Want to know what it takes to catch a VC’s attention? Study the patterns.

3️⃣ Understand the Ecosystem: These companies shaped entire industries—this is a front-row seat to their origins.

👉 Access the memos now with the free trial or subscribe to the premium plan for full access.