Ramp vs. Brex: How the Underdog Won

Capital One acquires Brex for $5.15B. Ramp soars to a $32B valuation. Wait – how did that happen?

Capital One acquires Brex for $5.15B. Ramp soars to a $32B valuation.

Wait – how did that happen?

This is the tale of how a scrappy late-comer (Ramp) went from underdog to top dog, out-executing an early fintech darling (Brex) despite Brex’s massive head start.

Index:

The King and the New Challenger

Different Game Plans: Rewards vs. Relentless Efficiency

When the King Stumbled – and the Underdog Pounced

The Tortoise and the Hare – Execution Beats Hype

Final Score: Ramp Wins, Brex Cashes Out

1. The King and the New Challenger

In the late 2010s, Brex was the king of startup corporate cards. Founded in 2017 by two young entrepreneurs, Brex quickly solved a big pain point: giving newly-funded startups high-limit corporate credit cards with no personal guarantee. VC money was flowing, startups needed to spend, and Brex swooped in with easy credit and juicy rewards. The result? Hypergrowth – Brex rocketed to $100M in ARR within 18 months of launch.

Investors lined up to crown Brex as fintech royalty: by mid-2019 Brex had raised over $280M from top VCs (Kleiner Perkins, Ribbit, DST, IVP, Greenoaks, etc.) and was valued at $2.6 B.

Meanwhile in 2019, Ramp was born in Brex’s shadow. Ramp’s founders (who had previously sold a startup to Capital One) raised a modest seed round – on the order of just a few million dollars, valuing Ramp under $20M. In early 2020, while Brex’s valuation stood around $2.7 B, Ramp’s was roughly $75 M (Brex was ~37× larger!).

In startup land, that gap looked almost laughable. Brex was the 800-pound gorilla; Ramp was the tiny newcomer copying the king. Many assumed Brex had already “won” the corporate card space.

2. Different Game Plans: Rewards vs. Relentless Efficiency

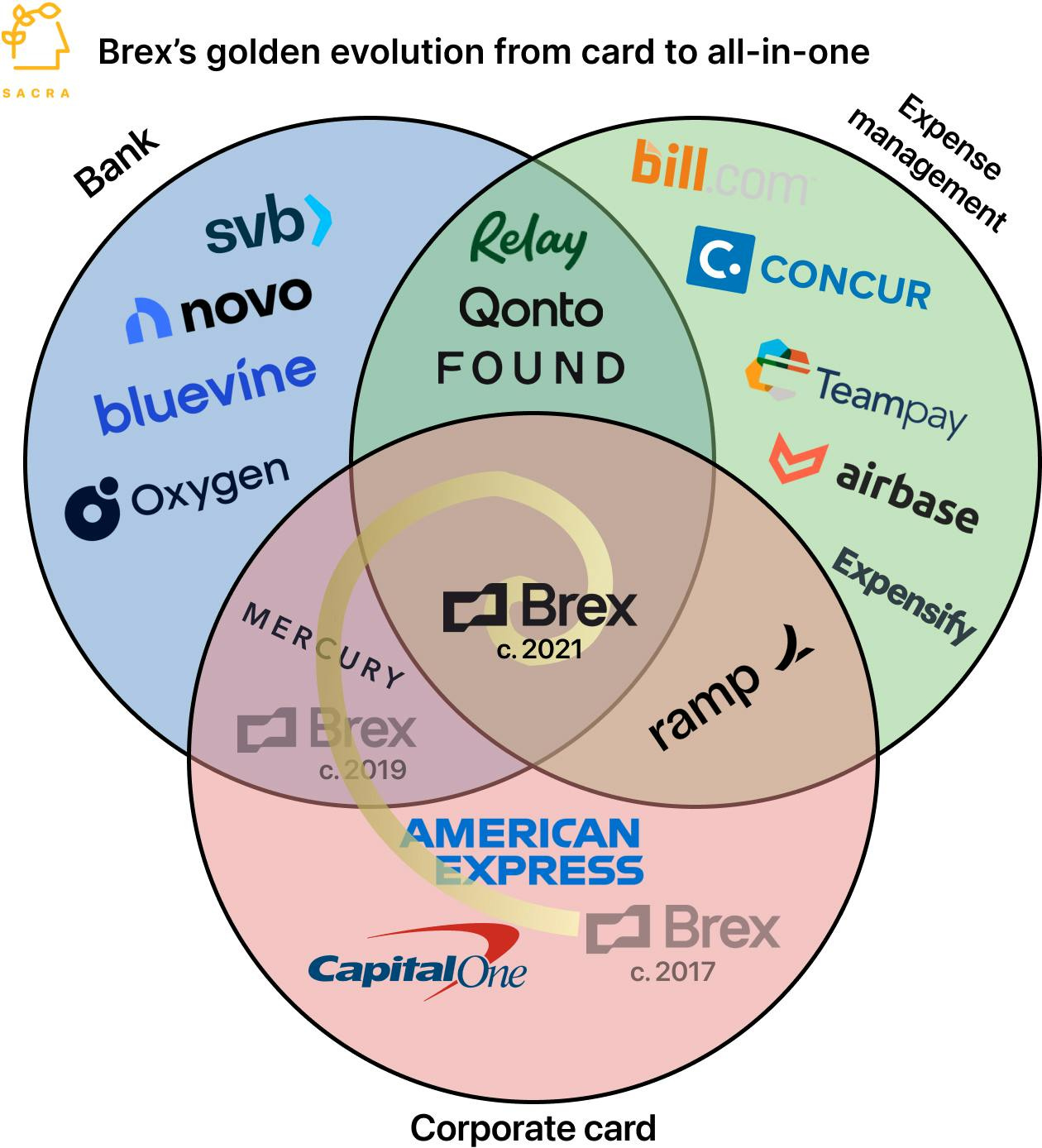

From day one, Brex and Ramp played different games. Brex’s strategy was to celebrate spending – give startups high credit limits, charge no fees, and encourage heavy spending by offering flashy rewards points (e.g. points for Uber, Slack, travel) to drive adoption.

Brex monetized via interchange fees and later added banking and software, but the ethos was “grow fast, spend big.” Ramp took a very different tack: it positioned itself as the frugal and efficient alternative. Instead of fancy points, Ramp offered a straightforward 1.5% cash back on all purchases and free expense management software – essentially, Ramp’s model celebrated cost savings and financial discipline.

One industry observer summarized that while Brex’s model “celebrated spending (and getting rewards), Ramp’s model celebrated efficiency and financial discipline”.

Ramp bundled tools to help companies limit spend: real-time spend controls, automated expense reports, and analytics to identify waste. The pitch was “we’ll save you money, not help you burn it.” For a while, this “prudence over points” approach earned Ramp the label of a niche copycat – useful for penny-pinching finance teams, perhaps, but nowhere near unseating Brex.

After all, in early 2020 Brex was valued ~$2.75B vs. Ramp’s paltry $75M.

Brex was king; Ramp was the quirky upstart.

3. When the King Stumbled – and the Underdog Pounced

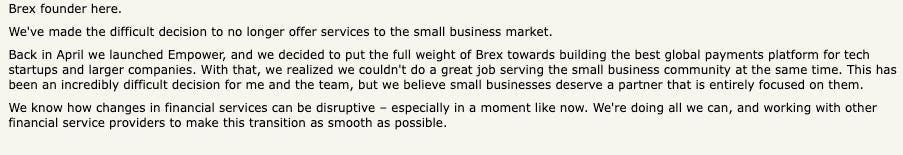

Brex’s first slip came in mid-2022. In a controversial move, Brex announced it would stop serving a large swath of its customers: small and medium-sized businesses (SMBs) that weren’t venture-backed.

Brex had initially grown by courting startups of all sizes, but as it pursued bigger enterprise clients, it decided to ditch “traditional” small businesses and require customers to have professional funding. The result: tens of thousands of startups and SMBs got booted off Brex with just weeks’ notice.

The fallout was ugly – furious small business owners vented that Brex “left us out to dry”.

Brex’s brand took a hit for seeming to abandon the very startups that made it successful.

And guess who rushed in to scoop up those frustrated customers? Ramp. Ramp seized the moment, openly embracing the SMBs and early-stage startups that Brex cast aside

Ramp’s CEO even tweeted offers to help stranded Brex customers. This move instantly widened Ramp’s market and reputation. Ramp’s revenue run-rate doubled within months as it onboarded thousands of businesses Brex left behind.

The upstart suddenly looked far more founder-friendly and inclusive, while Brex appeared focused only on elite clients.

This was a turning point. The perception of the two rivals began to flip: Ramp as the scrappy, customer-focused executor; Brex as the overfunded giant that took its eye off the ball.

4. The Tortoise and the Hare – Execution Beats Hype

Beyond that strategic blunder by Brex, a bigger force was at play: market conditions flipped.

During the go-go 2018–2021 era of zero interest rates and easy VC money, Brex’s spend-heavy approach made sense – startups cared more about growth than saving pennies. But by 2022-2023, the party was over. Interest rates climbed, VC funding slowed, and suddenly every company cared about efficiency and runway. The timing was perfect for Ramp. “When the era of free money ended, fintech narratives moved away from vanity metrics like total spend volume toward sustainable economics. Ramp was already positioned for this new reality,” one analysis noted.

In other words, Brex’s “woohoo, spend more!” vibe was falling out of fashion, while Ramp’s “let’s save money” message became very attractive.

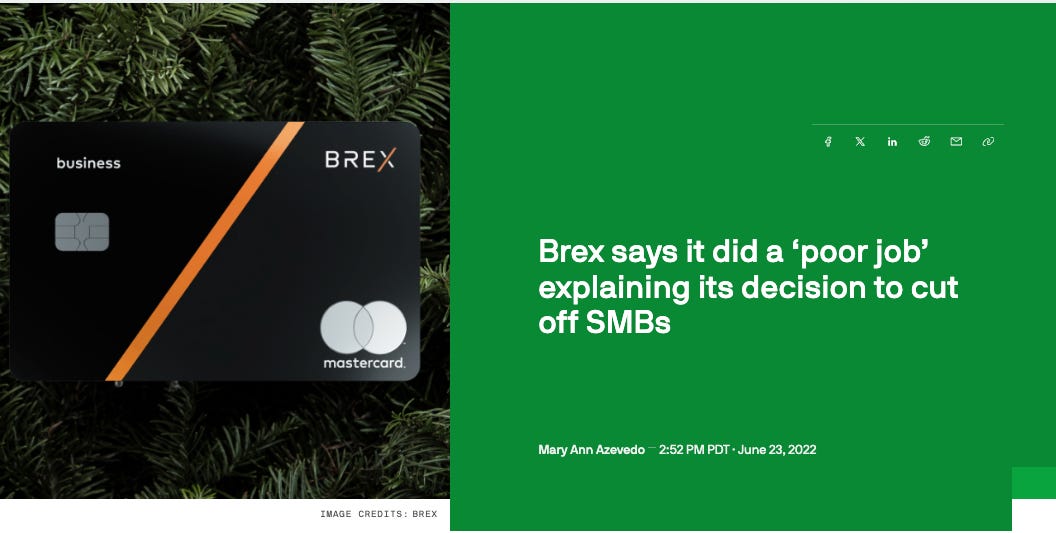

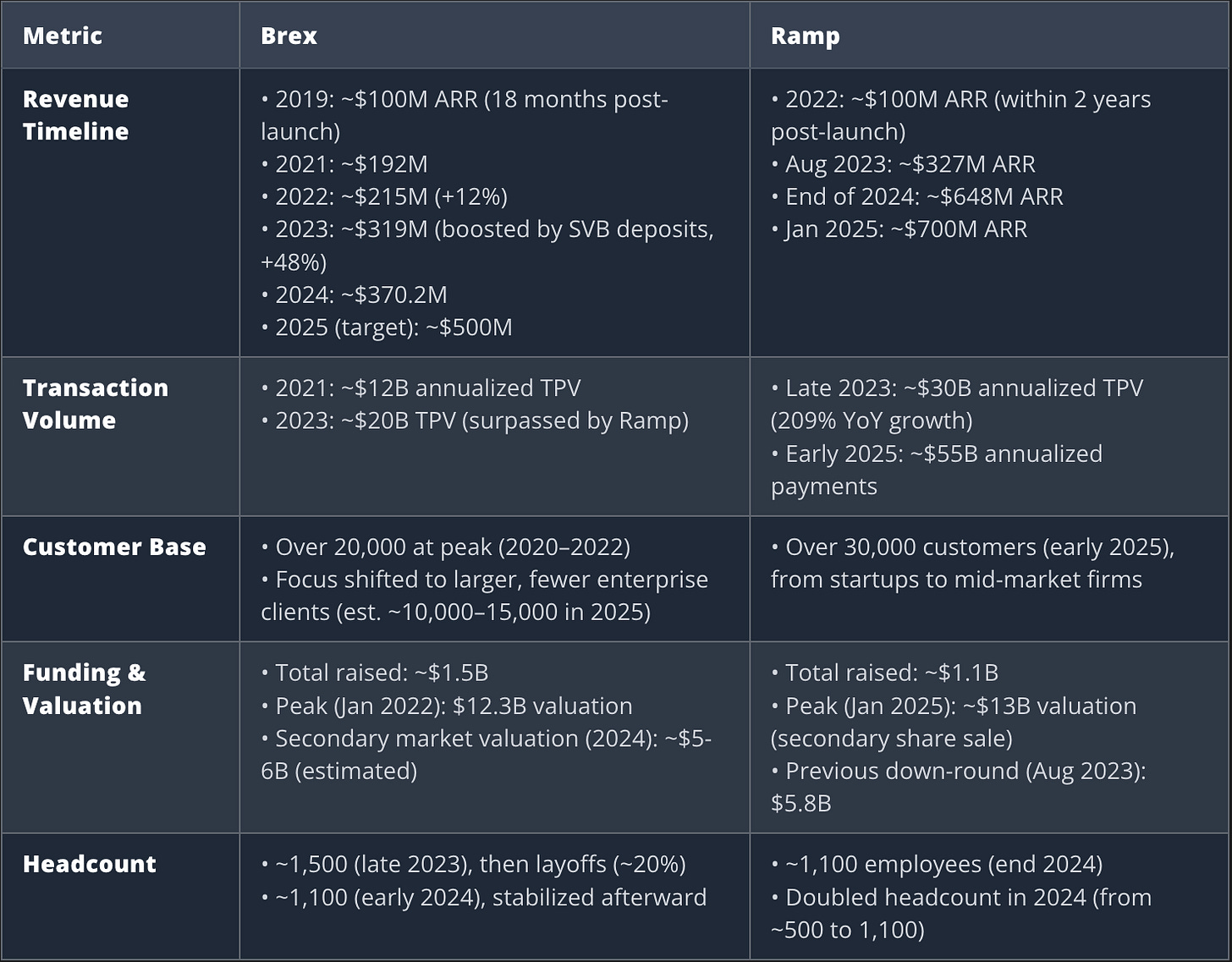

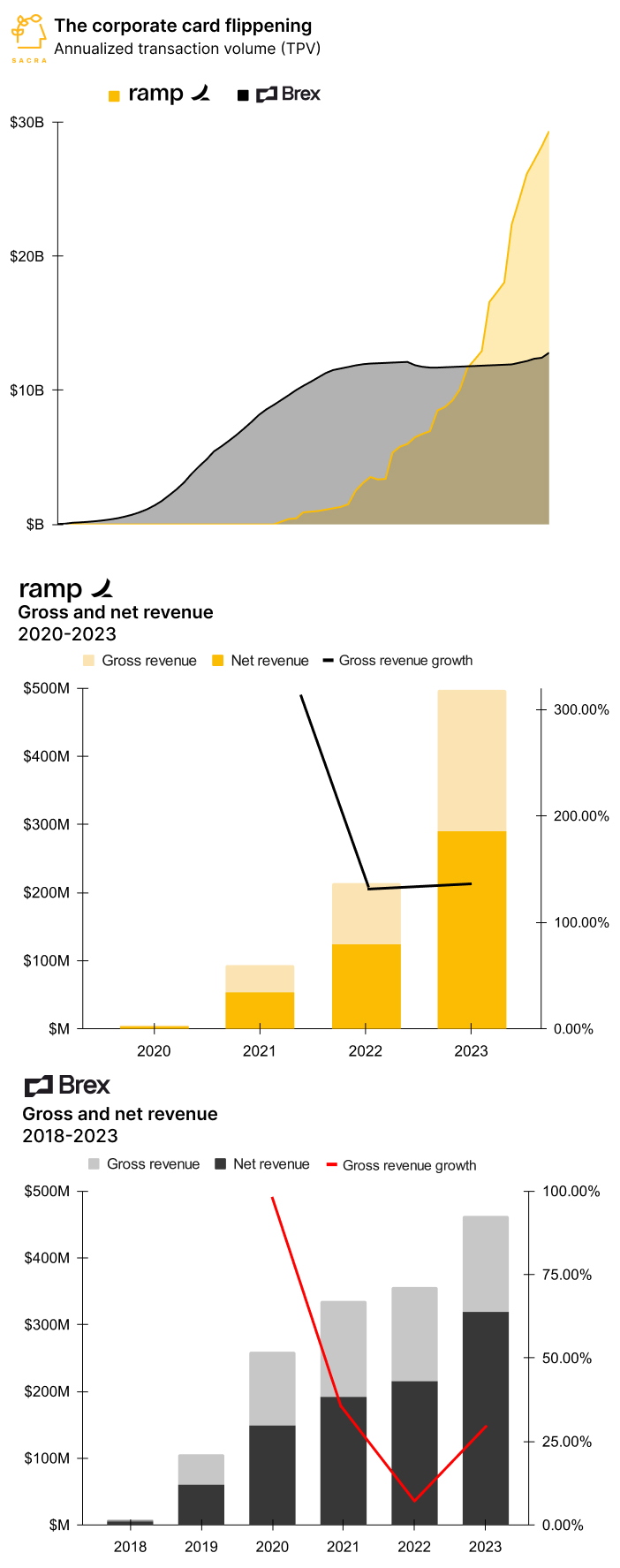

Ramp executed relentlessly to seize the moment. It kept rolling out new features at a rapid clip – for example, launching a Bill Pay product that helped drive its total payment volumes past Brex’s by late 2023.

Ramp also maintained a lean operation. (Fun fact: Ramp’s team remained much smaller and more cost-efficient than Brex’s, even as it scaled. Brex, by contrast, had hired rapidly during the boom and later admitted that hypergrowth had “masked areas needing improvement” operationally, forcing a late 2023 reorg to cut fat.)

All these factors compounded: better focus, better product timing, and better operational efficiency. And the results started to show in the only place that matters – the scoreboard 📊:

Brex’s valuation peaked at $12.3 B in January 2022 after a funding round led by Greenoaks. That was its last big private raise – after early 2022, Brex never raised again. Growth had slowed (Brex’s revenues in 2022 reportedly stalled around ~$215M, only +12% YoY).

Ramp hit some headwinds in 2022-23 but then went into overdrive. It became a unicorn in 2021 and had a valuation of about $8 B in early 2022. Like many fintechs, Ramp saw a valuation dip in 2023’s downturn – August 2023, it raised $300M at a $5.8 B valuation (about 28% lower than its prior round). But that “reset” was short-lived; Ramp was just getting started.

In 2024 and 2025, Ramp went on an absolute tear. Demand for its cost-saving platform exploded, and investors kept fueling the rise. Consider this crazy timeline:

April 2024: Ramp raises $150M at a $7.65 B valuation (Series D).

March 2025: Raises $150M (secondary sale) at $13 B valuation.

June 2025: Raises $200M at $16 B valuation (Series E).

July 2025: Raises $500M at $22.5 B valuation (Series E-2).

November 2025: Raises $300M at $32 B valuation (Series E-3)

Yes, you read that right – four fundraising rounds in 2025 alone, vaulting Ramp’s worth from $13B to $32B in just 8 months.

Investors were effectively saying, “Take our money, Ramp, now go conquer the world!” Meanwhile, Brex’s valuation decreased in that period. By late 2025, Brex’s implied value was slipping below $6B as it sought an exit.

On the business metrics side, the story was similar:

Ramp blew past Brex in revenue and customer growth. By late 2025 Ramp surpassed $1 B in annualized revenue (doubling in one year) and reached over 50,000 customers. Brex, in contrast, was reportedly around $700M revenue in 2025 and had perhaps 10–20k customers (after culling SMBs). Ramp’s broader market approach let it accumulate a bigger user base, and its product execution translated into higher revenue momentum. In October 2025, Ramp even announced it was free cash flow positive – showing that growth didn’t come at the expense of good unit economics. Brex was still likely burning cash up to the acquisition.

Total financing: Ramp raised a total of ~$2.3B by 2025 , giving it a huge war chest (and it was reportedly very cash-efficient in spending it). Brex raised around $1.5B in total. Despite Brex’s head start in funding, Ramp ultimately secured more capital – but only after proving its execution and market fit. Early on, Brex’s funding advantage looked insurmountable; over time, Ramp flipped the script.

By late 2025, it was evident to industry watchers who had the momentum. As TechCrunch wryly noted, Brex “lost momentum” just as Ramp was “going on a tear”.

The once mighty Brex found itself trailing in the innovation and growth race, lapped multiple times by its formerly diminutive rival. For Brex’s early investors, this was still a win (it was a multi-billion exit, after all). But the price tag tells a dramatic story – $5.15B is less than half of Brex’s last private valuation of $12.3B.

5. Final Score: Ramp Wins, Brex Cashes Out

In January 2026, the race effectively ended: Brex agreed to be acquired by Capital One for $5.15 B. For Brex’s early investors, this was still a win (it was a multi-billion exit, after all). But the price tag tells a dramatic story – $5.15B is less than half of Brex’s last private valuation of $12.3B.

A king that once sat atop a $12B throne was sold at a steep discount after stumbling in the race.

Ramp, on the other hand, remains independent and flying high. With a $32B valuation, Ramp is valued 6× higher than Brex’s sale price. More importantly, Ramp emerged as the perceived leader in the corporate spend space. It’s now the heavyweight to beat, with scale and resources to continue expanding (and ironically, with many of Brex’s former customers and much of the startup ecosystem on its side).

For founders and VCs, the Ramp vs. Brex saga is one for the ages. It’s a reminder that in startups, the game is never truly “over” just because one player raised an enormous round early on. Brex’s early lead was indeed daunting – they had all the funding, fame, and momentum one could ask for. Yet, a focused newcomer with a better product-market fit and relentless execution was able to not only catch up, but overtake the incumbent in spectacular fashion.

So next time you hear “Company X raised a mega-round, how can anyone else compete?” – just remember this story. The world belongs to the daring. Build. Sell. Execute. Don’t be intimidated by the reigning “king” in your space; if you out-execute them, you just might end up wearing the crown.

Hope you enjoyed,

Guillermo