How to pitch to investors. The startup pitch framework + data room template + what only 1% entrepreneurs do + favorite deck slides

The storytelling approach to pitching your startup, organizing your metrics and fundraise

Hey everybody! Welcome back to Product Market Fit 🚀🚀

I hope you are all doing great!

💡 This week’s announcements 💡

I’ve recently made my first angel investment of a company called Frontnow!

They grew to +1M ARR in less than 9 months! I was lucky to have met one of the founders before their seed round and loved his vision to grow a huge company. They closed a round recently lead by Peak Capital.

Also, I talked about Product Market Fit at a podcast! Check it out if you are bored 🤣

Now, on this article you’ll find:

How to pitch to investors 🔊

The basics

What not to do

What the best do

The startup pitch framework 👨💻

Data room notion template created by me 🤑

PREMIUM: what only 1% of entrepreneurs do + my favorite deck slides and full decks

But first, and as always, some good music to get us moving! 🔥🔥

1. How to pitch to investors

The basics:

Venture Capitalists have an investment thesis they have to follow. If your startup doesn’t fit the investor’s thesis don’t bother pitching

Most times you’ll start pitching to associates. Then the associates will have to share the opportunity with the rest of their investment team. The easier you make their job the more chances you have.

How you pitch your startup gives out a lot of information about you to investors. Make sure your investment materials are organized, your pitch is concise and to the point and you are likeable.

Never look desperate, you’ll scare off every investor.

What not to do:

Never, ever lie. Investors detect bullshit miles away. Their job is basically that. So, if you don’t know something, just say it. It’s better to say “we still have to test this go to market strategy and see if it works” than to say “it will work for sure”.

What the best do:

Follow up. If you are waiting for news from an investor and he’s forgetting to answer back, follow up on him. If you don’t, he might just think you aren’t interested enough and he will also lose interest in you.

Create relationship with the investor. You can do this although you don’t really need to. Your results are the best driver not your friendships.

2. The startup pitch framework

What is a MECE framework and why you should always use them

MECE is a problem-structuring framework that organizes data into simple and logical categories. The concept was developed by Barbara Minto at McKinsey back in the 1960s, but it is still widely used across consulting firms today.

The MECE framework consists of two rules:

Mutually Exclusive (ME): All categories or items being used to analyze a problem must not overlap. Meaning each item should fit into one and only one category.

Collectively Exhaustive (CE): All categories or items being used to analyze a problem must cover all possible options without any gaps.

Together, these two rules can help you translate complex information into simple and logical categories.

Learn more about it here.

The startup pitch framework

The idea behind this framework is to properly organize your startup’s information to display the most important indicators.

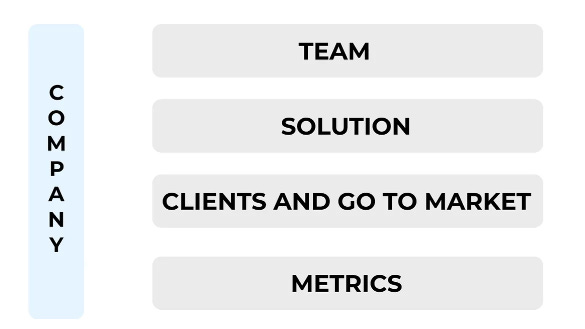

The framework is divided into 3 parts:

Internal aspects (The Company)

External aspects (The Market)

Business Case (The Round)

1. Internal aspects: The Company

In this section you have to share what it is that makes your company great 🔥

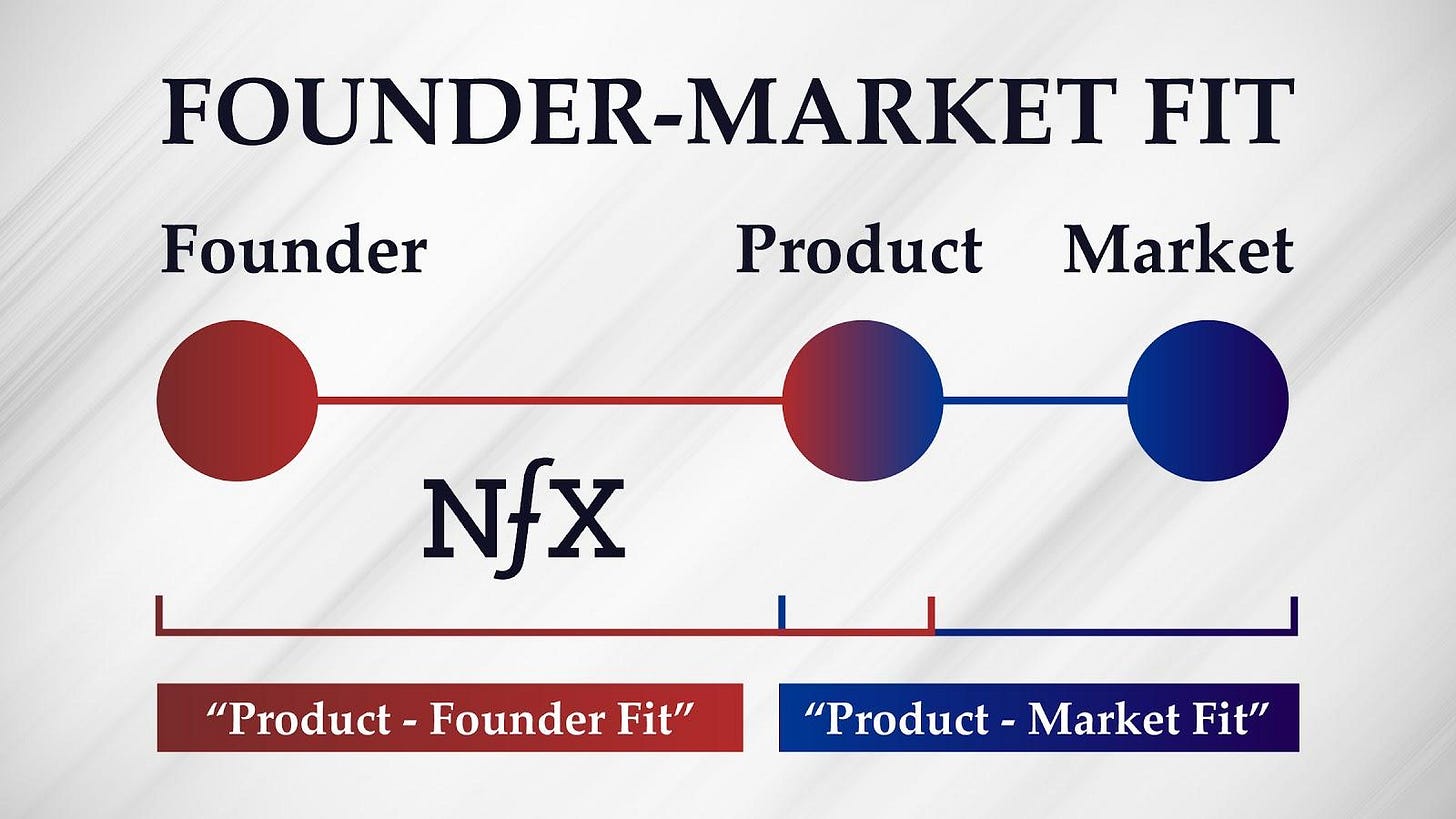

Prove you are the best team to build that startup

You can start by introducing yourself and your team and explain what motivated you to start the company.

The most important thing here is to show how you have a competitive advantage that makes you the best team to build this exact solution.

For example:

Wiz had a world class founding team

All four founders:

Had market fit: they knew the cybersecurity market and problems in depth.

They had been working on it for at least 10 years

Had built before a big successful company in the cyber security industry

Had a great investor network internationally

Had access to world’s biggest corporations to sell their product

That is great fit!

Show how your product creates huge value

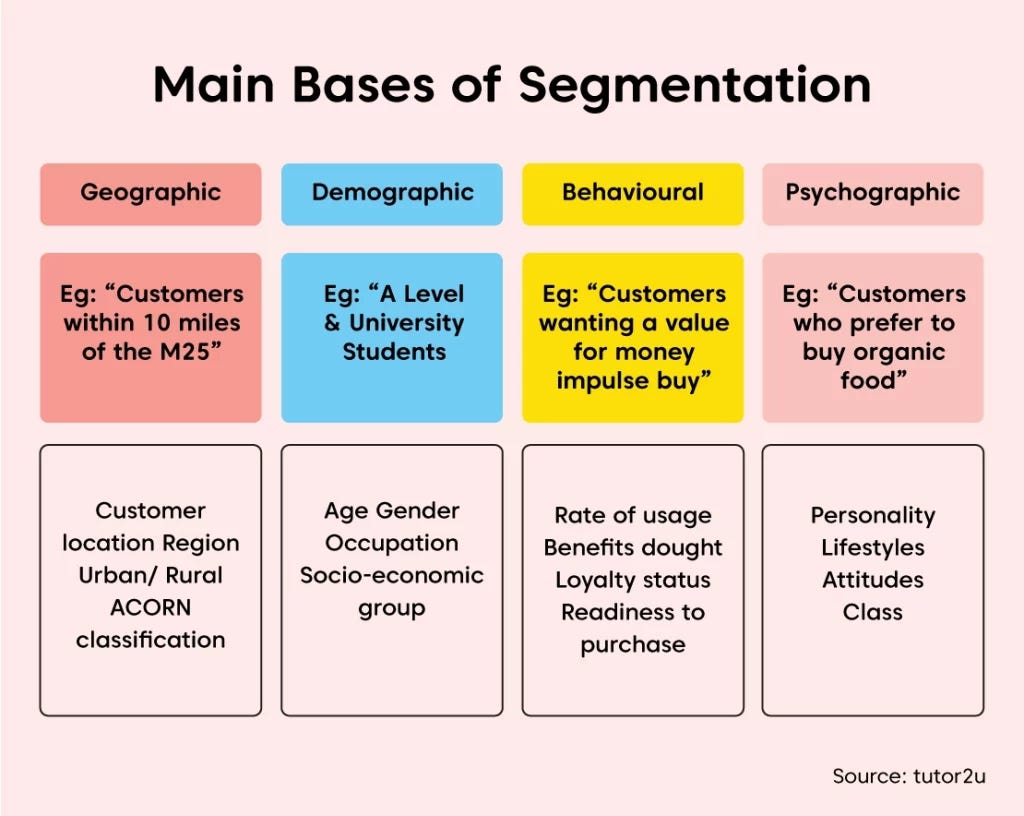

Explain how relevant are your clients, how diverse, geographically dispersed, and how you are acquiring them

Here investors want to see:

How many clients you have

How much revenue you gain per client

How concentrated the revenue is

What is the relevance of the clients

How they are distributed geographically

Show how demand is accelerating and your clients keep using your product

In the end it all comes down to 2 things:

How fast you are acquiring new clients and at what cost

How long they stay using your product and what they pay

This is what makes investors want to invest in your company.

It doesn’t take many x2 for a company to grow very big. If your company is doing 2x in its north star metrics investors will fight to invest in it.

Check out how Rewind’s CEO showed this graph on his pitch deck 👇

2. External aspects: The Market

This is how you prove investors your company will keep on growing.

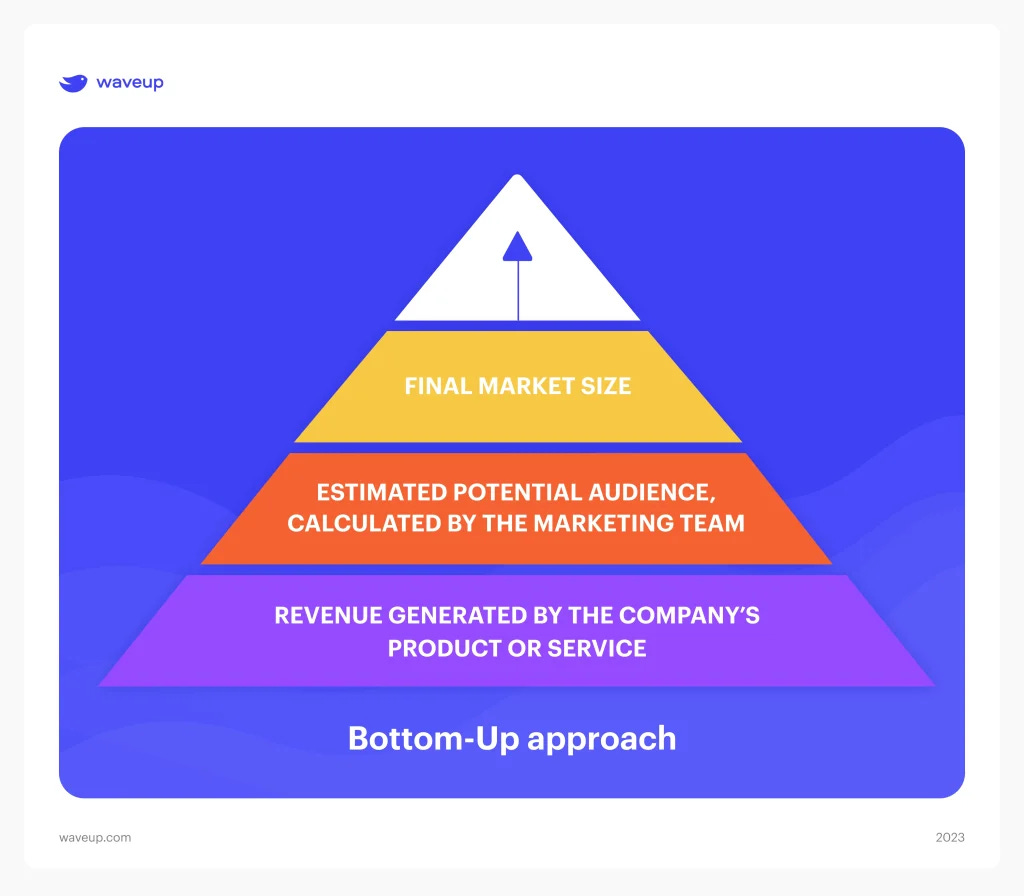

Prove investors there is a huge market opportunity with a bottom up approach

Investors don’t want to see big numbers with no justification. Do your homework and identify with as much detail as possible how many potential customers there are for your product.

Show how fast that market is growing

If a market is huge and it’s growing really fast, it’s likely it will help your company grow at least at the same pace.

🚨 IF YOUR MARKET IS NOT GROWING OR NOT BIG ENOUGH, 99% OF VC WILL NOT INVEST🚨

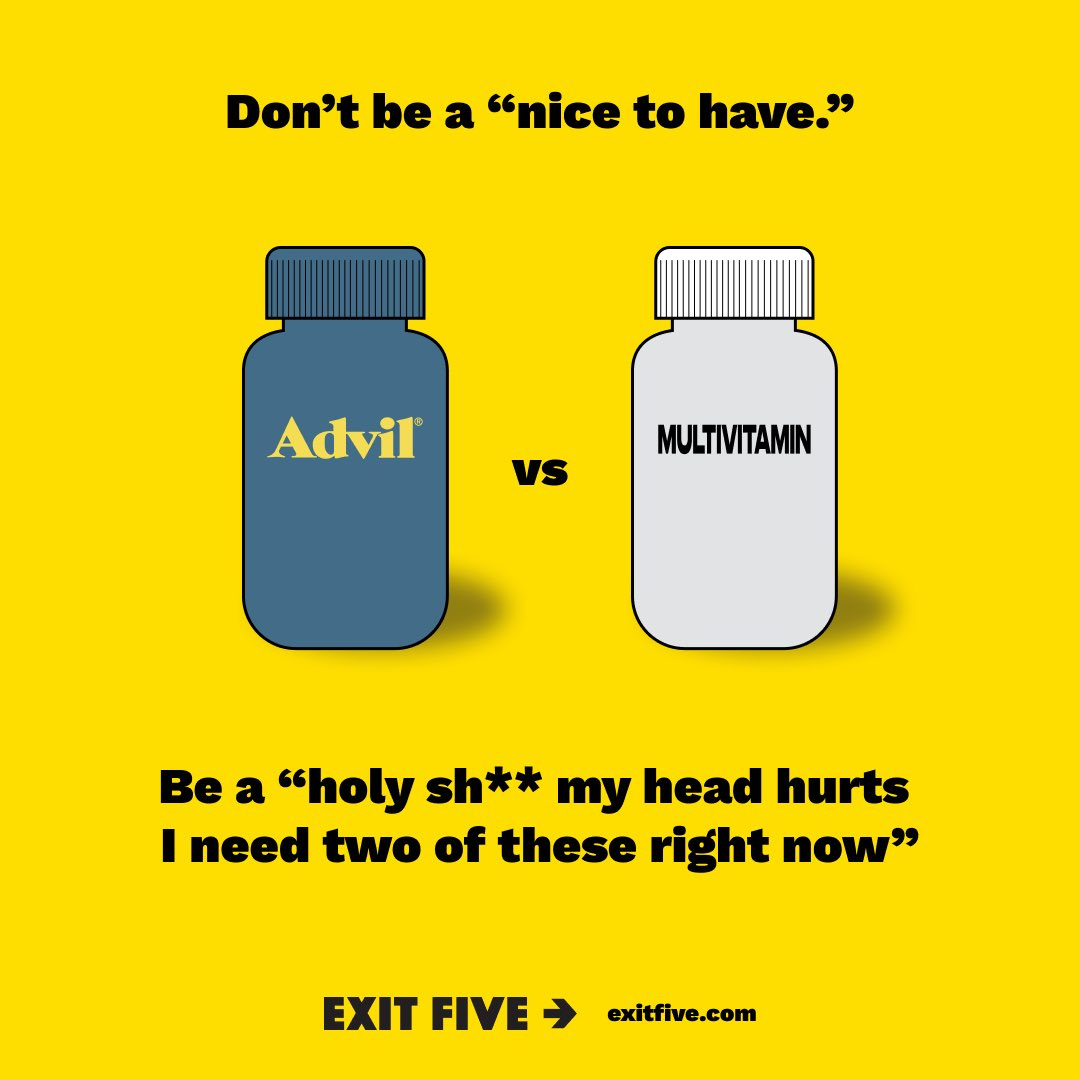

Explain how your product solves a pain in a different way/space than anyone and how that’s better

There’s always going to be competition. However, your product should target something so specific that you can have a competitive advantage. Look for that.

Read more about how to create defensibility here.

3. Business case: The round

This is the part where you show investors it makes sense for them to be a part of the funding round.

Show how you’ve got a clean captable and the VCs that invested previously are going to follow on this round.

🚩🚩 RED FLAG ALERT: VCs invest in entrepreneurs. If the founders don’t have significant equity most VCs will not invest

✔️ Seed Rounds: +75%

✔️Series A: +60%

✔️Clean captable with 1-3 VCs or 1-3 BAs

❌ Captable with multiple non professional investors

❌ VCs not following on the round

Show investors how you are going to invest their money and how it will ROI

This part is critical and where so many entrepreneurs miss. Not many investors will invest in something that isn’t growing.

You have to go out to fundraise when the company is going the best and close it fast.

You have to show how fast it can grow if you use their money to distribute the product!

Most investors are valuation sensitive. Make sure you don’t waste your time with investors that don’t see you company growing 10x

If you are raising a series A round at $60M Valuation, the first thing investors will think about is: can this company reach $600M Valuation?

At a 20x multiple you’d need $30M ARR to $600M valuation so bear that in mind when pithing your business plan.