Hey everybody, welcome back to Product Market Fit, my name is Guillermo Flor and I’m a former startup founder now working as a Venture Capital Investor at Gohub Ventures.

On this article I want to give out a guide on how to fundraise from Index Ventures DISCLAIMER: This article is based only on my own research and I have no affiliation with Index Ventures).

You’ll find:

Introduction Index Ventures Investment Thesis

What Index Looks for in an Investment

How Index finds deals and what you can do to get noticed by them

1. Introduction to Index Ventures

Index Ventures is one of the predominant European Global Venture Capital Funds born in Europe.

It has dual headquarters in San Francisco and London, and invests in technology-enabled companies with a focus on a focus on e-commerce, fintech, mobility, gaming, infrastructure/AI, and security (industry agnostic really).

Since its founding in 1996, the firm has invested in a number of companies and raised approximately $5.6 billion.

They’ve invested amazing companies to date, and being invested by them is a quality mark for any company.

Index’s Investment Thesis

Index is a multistage fund, which means that they invest since seed to IPO and accross every sector investing in entrepreneurs mostly in the U.S. and Europe.

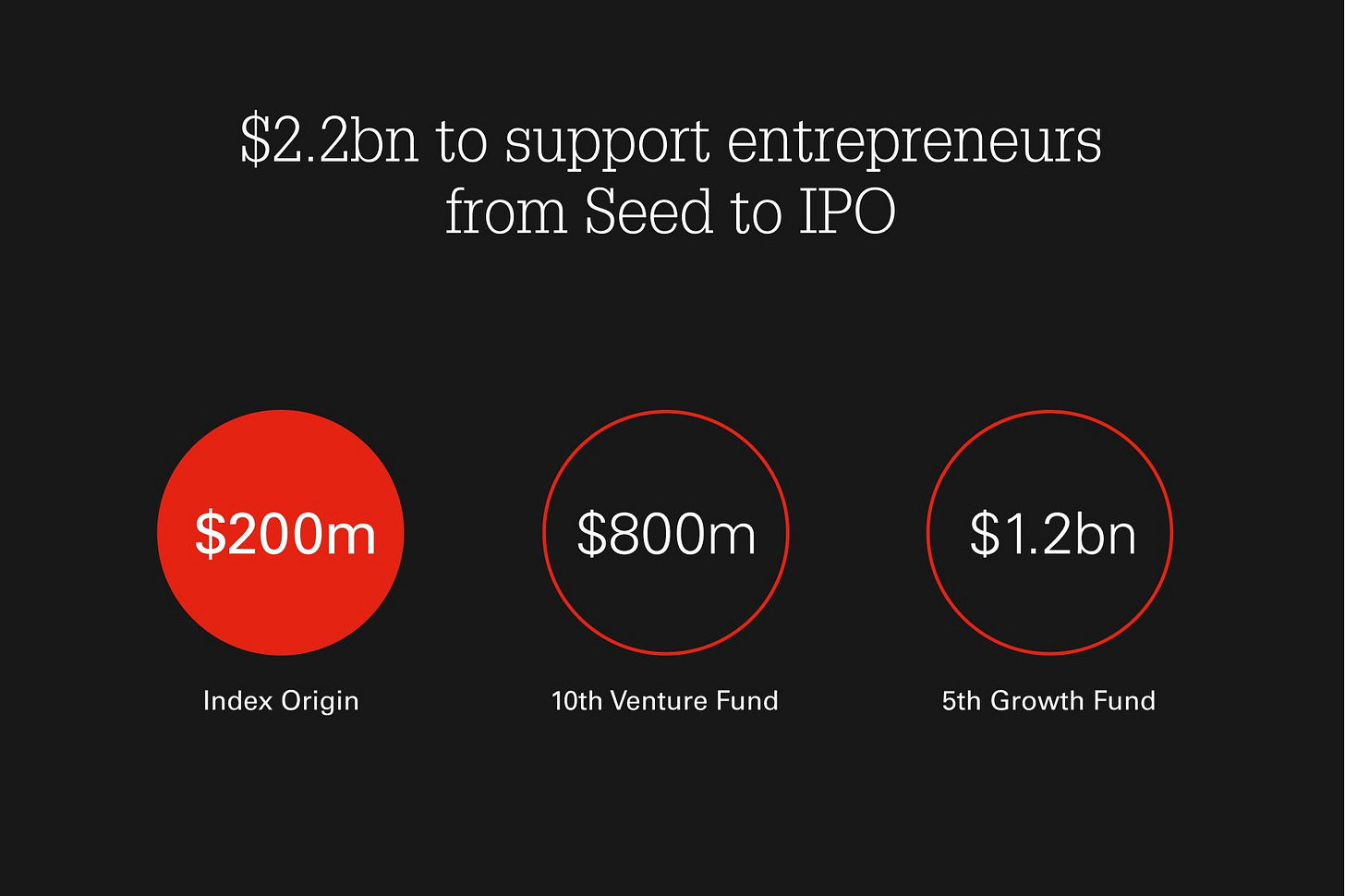

In order to do this they have 3 types of funds: Index Origin, a Venture Fund (10th) and a Growth Fund (5th).

How early will Index invest at seed?

There’s no such thing as “too early” at Index. Dylan Field was a 20-year-old intern at Flipboard when he pitched Figma to Index.

In the last 18 months, Index has done nearly 40 seed investments, including companies such as Fast, Goody, Grid, Remote.com, Resistant AI, and Stytch.

How much do they invest?

Index Ventures will often seek to invest between $100K and $2 million as pre-venture investment in early-stage companies. Investments at a later stage of development are assessed according to the business potential of each company.

2. What Index Looks for in an Investment

1. Passionate and Committed Founders:

Founders who are passionate and visionary.

Ability to engage stakeholders: employees, investors, customers.

Demonstrated commitment to overcoming obstacles.

Preference for founding teams with diverse skill sets.

2. Innovation and Disruption:

Unique market insights.

Creative and innovative products or services.

Disruptive solutions that transform industries.

Not limited to new technology; includes inventive marketing or distribution techniques.

3. Market Size:

Target for "significant minority" stakes in companies.

Potential for large exits (hundreds of millions to billions of dollars/euros).

Avoidance of investments with capped returns due to market size constraints.

Hey hold on!! Get some rest from the article and check out my video of how to improve your investor’s pitch. Subscribe for more 👇👇

3. How Index Ventures finds deals and what you can do to get noticed by them

Index Ventures likes to build personal relationships with founders early, but they are very selective on who they build them with.

They source deals three ways:

1. Thematic research.

Index continually undertakes research into sectors or industries where they believe disruptive companies can emerge;

They would just check every startup in one category, just like down below 👇

🚨 It’s not really hard to know what sectors or industries Index will be researching at any given point, but you can’t adapt what your company does to every trend, so getting contacted because of this is mostly about timing and luck.

2. Direct contact

Deals where companies spontaneously and directly contact Index Ventures through email, social media or events.

🚨 This is the worst channel for any big VC because they get thousands of direct contacts and they cannot go through every one of the deals (and you won’t stand out)

3. Referred Deals

Your best chance to get to talk to Index Ventures is through the Referred Deals,