How Rubrik's CEO hacked growth to achieve +$500M ARR in 10 years

From Product Market Fit to hyperscaling

Hey everybody welcome back to the Product Market Fit Newsletter 🚀

My name is Guillermo Flor and I write this weekly newsletter to help founders, growth professionals and product people to grow & fund their companies.

This week we are going to talk about Rubrik’s growth to +500M and we’ll give out a couple of golden nuggets for the premium subs! 💰

But, before getting into it, I have great news for you! Fred Again released another song 🔥 Enjoy it!

News!

I’m opening up 2 hours of free weekly consulting for startups fundraising or going to market. Find a slot here. (Soon to release Podcast)

Inbound website is live! If you know any company that might be interested, an itro would be great!!

How Rubrik grew to $500M ARR

a cybersecurity and data protection company founded in 2014 by

Bipul Sinha

Arvind Nithrakashyap

Soham Mazumdar

Arvind Jain

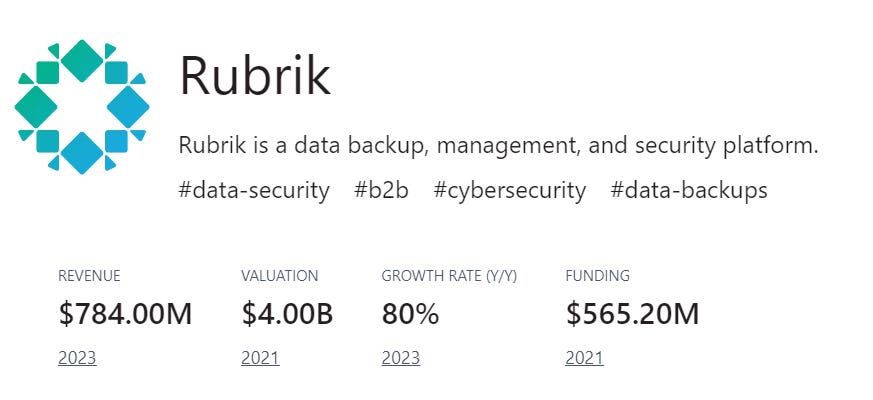

They IPO’d on April 25th, 2024 at a valuation of $5.6 billion.

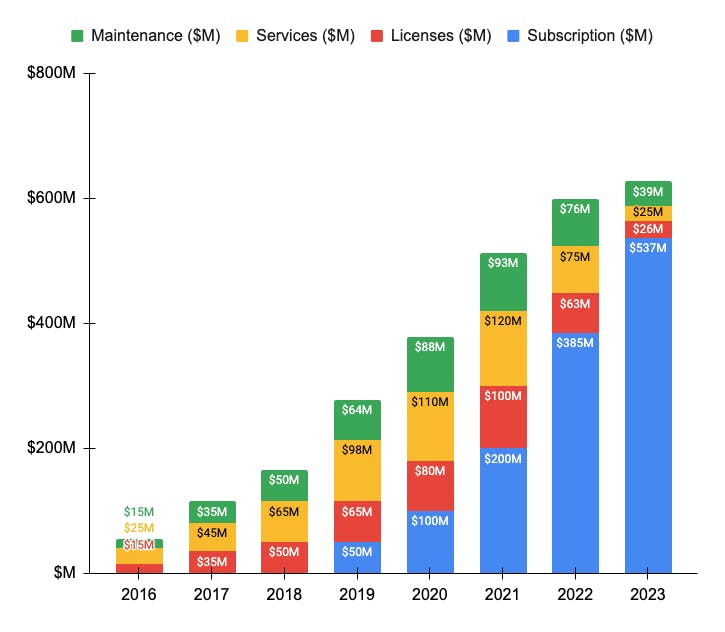

As of this year, Rubrik serves 5,000 customers globally and surpassed $500 million in subscription annual recurring revenue (ARR).

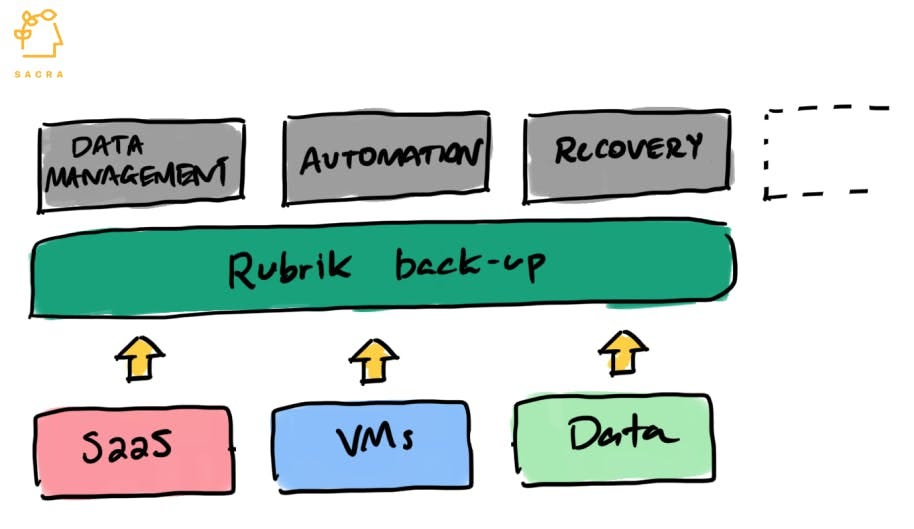

What is Rubrik?

In a sentence, Rubrik is a provider of cloud data management and cybersecurity solutions.

The company's flagship offering is the Rubrik Security Cloud - a comprehensive data security platform that delivers cyber resilience through three key capabilities:

Cyber Posture Management

This allows organizations to discover, classify, and monitor sensitive data across their environments to identify potential risks and ensure compliance with data privacy regulations.

Cyber Recovery

Rubrik provides immutable, air-gapped backups to protect data against ransomware, malicious insiders, and operational disruptions. It leverages machine learning for anomaly detection and enables rapid data recovery to a secure state prior to an attack.

Threat Hunting and Containment

This capability helps contain active threats, investigate the blast radius through behavioral analytics, and quickly recover clean data without risk of reinfection.

Rubrik's solutions cover data protection use cases across on-premises, cloud (private/public), and SaaS environments for databases, applications, operating systems, and SaaS workloads like Microsoft 365. Key offerings include cloud backup, disaster recovery, data archival, analytics, compliance, and ransomware recovery.

Founding Team

Bipul Sinha : CEO, Chairman and Co-Founder

Former Venture Partner at Lightspeed Venture Partners (2010 - 2014)

Former Venture Partner at Blumberg Capital (2008 - 2010)

Engineer to director at Oracle

Arvind Jain : Co-Founder and Vice President of Engineering

ex-Google distinguished engineer

Soham Mazumdar : Co-Founder and Chief Architect

ex-Facebook and Google

Arvind Nithrakashyap : Co-Founder and CTO

ex- Oracle

Played a key role in architecting initial data backup and recovery products and technology platform.

Leadership played a key role in the forming of this team, with Bipul pulling in each co-founder with complementary skill sets to work on his shared vision.

Problem

Data Sprawl and Fragmentation

"Valuable data is now commonly spread across multiple physical locations and different repository types...creating a problem of data sprawl and fragmentation." Rubrik provides a unified data management platform to consolidate and secure data across data centers, clouds, SaaS applications, and edge locations.

Rapid Data Growth

The search results highlight that data volumes are growing exponentially, with Rubrik stating "data grew more than 25% in 2022" and is projected to "triple in the next five years" for a typical organization. Rubrik's solutions help organizations secure and manage this rapidly growing data.

Cyber Threats like Ransomware

Rubrik focuses on delivering cyber resilience by protecting against threats like ransomware through capabilities like immutable backups, anomaly detection, and rapid data recovery.

Data Privacy and Compliance

With organizations storing millions of sensitive data records, Rubrik enables data discovery, classification, and monitoring to ensure compliance with regulations like GDPR.

Unlocking Data Value

Rubrik helps organizations "leverage data to its fullest extent" and "unlock critical insights from their data" through capabilities like metadata management and data indexing across silos.

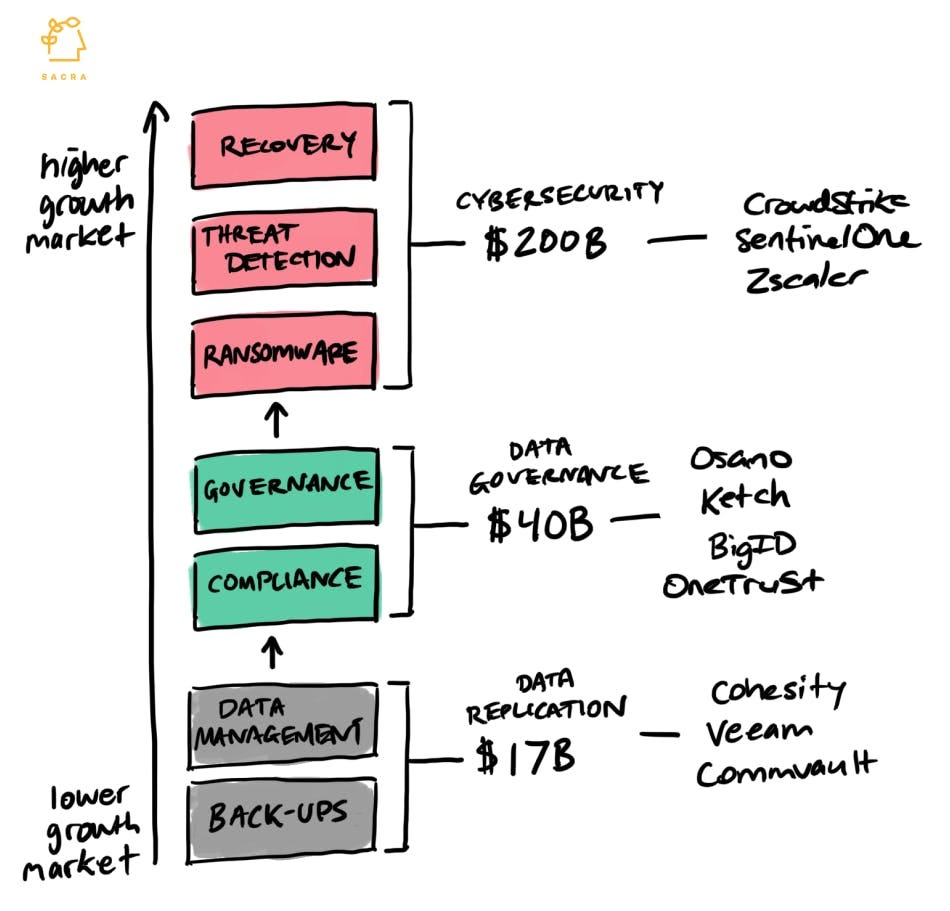

Cybersecurity

“The global economic cost of cybercrime is estimated to reach $10.5 trillion by 2025” - Cybersecurity Ventures

The average cost of a cyber breach in 2022 was estimated to be $4.35 million.

It is estimated $10 billion was stolen by cybercriminals in the US alone, which was a 32% increase from the previous year.

The Global cybersecurity market is projected to grow at a CAGR of 12.3% from 2023 to 2030 according t Grand View Research, although other source claim this number could range anywhere from 9.4% to 15.9%.

As you can see, the timing of Rubrik couldn’t have been better.

Funding

Initial Funding Rounds:

In 2015, Rubrik raised $51 million across Series A and B funding rounds.

Series C:

In 2016, Rubrik raised $61 million in a Series C funding round to boost sales momentum.

Series E:

In January 2019, Rubrik raised $261 million in a Series E funding round at a $3.3 billion valuation.

New investor Bain Capital Ventures led this round.

Existing investors Lightspeed Venture Partners, Greylock Partners, Khosla Ventures, and IVP also participated.

This brought Rubrik's total equity funding raised to over $553 million at that point.

Strategic Investment:

In August 2021, Microsoft made an investment in Rubrik during one of its financing rounds, strengthening their strategic partnership. The exact amount was not disclosed, however, at that time, Rubrik was valued at $4 billion.

Growth

As reported by Lightspeed Venture Partners, Rubrik was able to grow from 0 to $300 million in revenue in four years because:

Identifying Market Opportunity: Targeted a stagnant data management market.

Product-Market Fit: Engaged with customers early to refine their product.

High-Intensity Talent: Hired ambitious and capable employees.

Transparency and Culture: Fostered organizational transparency and a strong company culture.

Sales Incentives: Implemented ambitious sales goals and incentives.

Strategic Partnerships: Established early partnerships to expand market reach.

Supportive Investors: Chose investors who provided strategic guidance and support.

IPO

Rubrik went public on the New York Stock Exchange (NYSE) on April 25th, 2024, offering 23 million shares at a price point of $28 to $31 per share and raising a total of $736 million.

Rubrik’s IPO was 20 times oversubscribed.