from $5M fund at 24 to $25 billion under management: how Josh Kushner built Thrive

Inside Thrive Capital: How Joshua Kushner turned a $10M fund into one of the world’s most influential venture firms

this picture was published with an article by Fortune in 2023, right after Thrive Capital lead a tender offer financing of OpenAI shares that valued the startup at $86 billion. In august 2024, some reports said Thrive was investing another billion in OpenAI.

Josh Kushner started Thrive Capital at age 24. Now it manages +25 billion.

You are probably wondering, how’s it possible I haven’t heard about it?

Well it’s because of their intention of staying unknown.

This is their story:

VC isn’t the only way to raise money. you can also get Venture Debt from founderpath

Want to sponsor PMF Newsletter? Email me at g@guillermoflor.com

1. Founding and Joshua Kushner’s Vision (2009–2011)

Thrive Capital was founded in 2010 by Joshua Kushner at just 24 years old.

Kushner, a Harvard graduate (B.A. 2008, MBA 2011) and former Goldman Sachs analyst, launched the firm with an initial focus on early-stage media and internet startups.

He secured $5–10 million in seed funding to start Thrive – notably $5 million came from Joel Cutler of General Catalyst, who mentored Kushner and helped introduce early investors.

By 2011, Thrive raised its first institutional fund of $40 million with backing from prestigious institutions like Princeton University’s endowment, the Wellcome Trust (UK), and tech luminaries such as Peter Thiel, with General Catalyst again anchoring the fund.

Kushner’s motivation was to build a new kind of venture firm rooted in long-term vision and close founder relationships, an ethos influenced by his family’s immigrant hustle and his own entrepreneurial forays (he co-founded a social gaming startup called Vostu while in college).

From the outset, Thrive’s mission was to “build and invest in internet, software, and technology-enabled companies” and be patient, value-added partners to founders.

2. Early Growth and Milestones (2012–2014)

Thrive I and II gave the firm a solid start, enabling early bets on what would become iconic startups.

Thrive became one of three firms to invest in Instagram’s $50 million Series B round in 2012 (at a $500 million valuation); when Facebook acquired Instagram for $1 billion shortly thereafter, Thrive doubled its money within 72 hours.

This quick win boosted Thrive’s profile. Other early investments included Warby Parker, Codecademy, Spotify, Nasty Gal, MakerBot, and ResearchGate, reflecting a focus on consumer internet and digital media disruptors.

By 2014, Thrive had launched Fund III ($150 million in 2012) and Fund IV ($400 million in 2014) to capitalize on a growing pipeline of deals.

In its first four years, the firm raised roughly $200 million and established a reputation for spotting consumer-tech trends (e.g. social, e-commerce) ahead of the curve.

Notably, Kushner operated under the radar in these early years – Thrive’s website was famously minimal (“just one sentence of text”) and the firm maintained a “secretive presence”, avoiding the flashy self-promotion common among VCs.

This low-profile approach belied the strong network Kushner was quietly building and his ability to win competitive deals despite being based in New York (away from Silicon Valley’s core).

By 2014, Thrive’s lean team and founder-focused philosophy were firmly in place, setting the stage for larger funds and broader ambitions.

3. Expansion and Notable Investments (2015–2018)

As Thrive’s momentum grew, so did its fund sizes and the scope of its investments. Fund V (2016) closed at $700 million and Fund VI (2018) at $1 billion, a testament to LPs’ confidence in the firm.

During this period, Thrive transitioned from exclusively early-stage deals to a barbell strategy: still backing seed-stage startups while also chasing growth rounds of breakout companies.

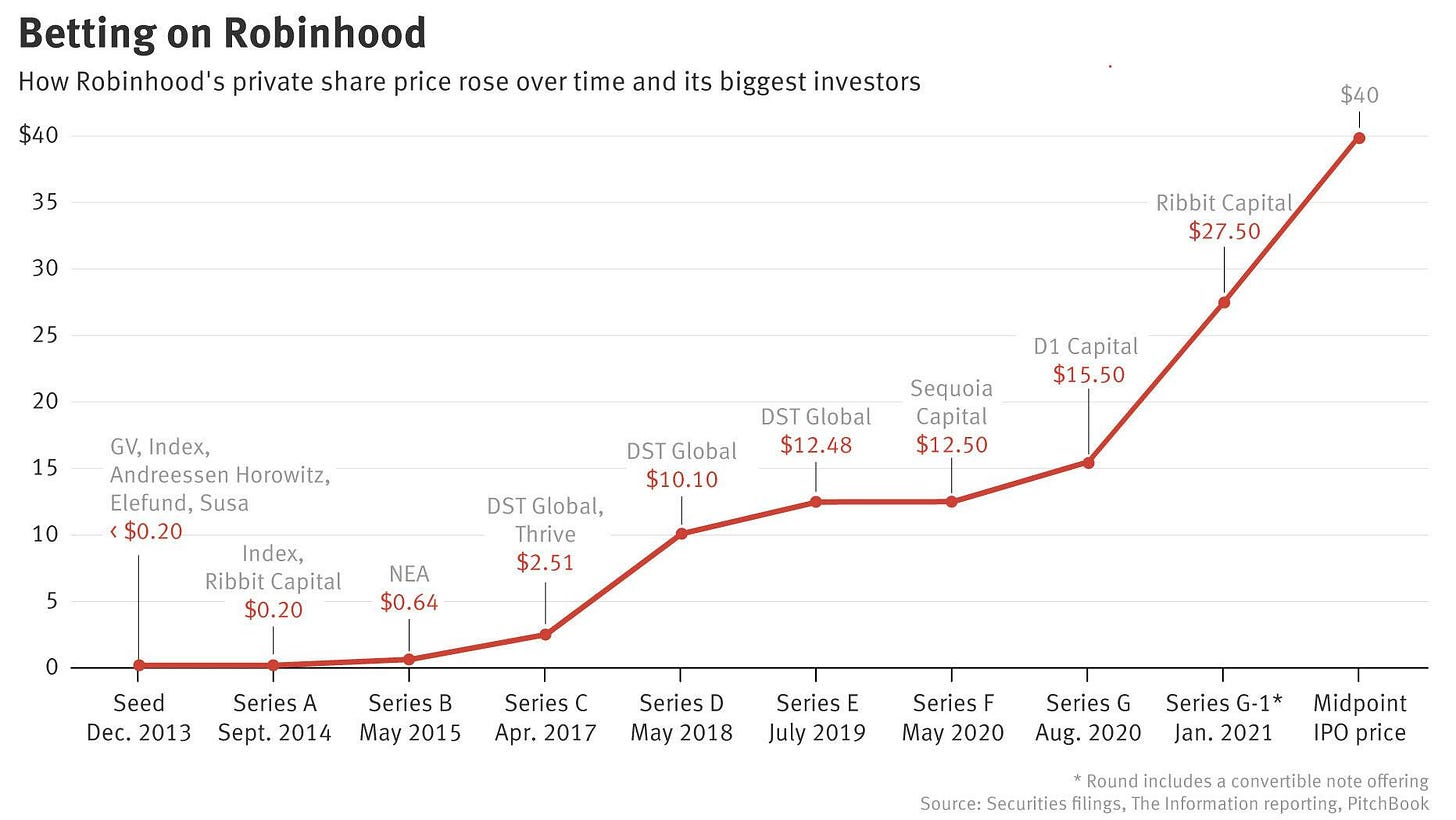

For example, Thrive led a major investment in Robinhood in 2017, joining its Series C when the stock-trading app was valued around $1.3 billion – that bet paid off as Robinhood soon became a fintech unicorn and later went public.

Thrive also gained exposure to enterprise and fintech winners: it invested in Slack, GitHub, and Stripe, companies that would achieve multi-billion valuations or exits. In healthcare, Joshua Kushner co-founded Oscar Health in 2012 and Thrive invested in it as it scaled; Oscar brought a tech-driven approach to health insurance and would later IPO (albeit with mixed results).