How Foreign Startups Raise Capital in the US - 7 startup examples

How foreign startups secure U.S. venture capital by dominating local markets or gaining early international traction. Learn from real examples like PrivateGPT, LuzIA, and Passionfroot, and un

Why U.S. Investors Are Crucial for Foreign Startups

The U.S. accounts for over 40% of global venture capital investments, making it the epicenter of startup funding. For foreign startups, raising capital from U.S. investors offers:

Larger check sizes: U.S. investors typically have deeper pockets than those in many other regions.

Market access: Connections to U.S.-based customers, partners, and advisors.

Prestige and signaling: Landing a U.S. investor often signals quality and opens doors to additional funding.

In 2023, foreign startups raised over $15 billion from US investors, accounting for a growing share of global venture capital activity.

Three Types of Startups That Raise Money from U.S. Investors

Foreign startups that successfully raise capital from U.S. investors typically fall into one of three categories:

1. Market Leaders Expanding Globally

These startups have already proven their business model by dominating their local markets.

They usually have significant traction, such as substantial revenue, a large user base, or strong partnerships.

Their goal is to expand into new markets, often including the U.S. Growth investors from the U.S. are drawn to these companies at later stages, typically Series B or beyond, because their success is already evident.

For instance, Revolut, the UK-based neobank, raised Series C funding in 2018, led by DST Global (having raised debt with TriplePoint Capital before that). By this point, Revolut had established itself as a leader in the European fintech space, offering multi-currency accounts, cryptocurrency trading, and payment solutions to millions of users. Its traction in the local market made it an attractive prospect for U.S. investors looking to back a proven success story with global ambitions.

2. Born-Global Startups with International Traction

Unlike local market leaders, born-global startups target international markets from day one.

These companies often build a significant share of their customer base in the U.S. early on and attract U.S. VCs at seed or early stages.

U.S. investors in this category often scout for startups that leverage new technologies, show viral growth, or demonstrate significant early traction internationally.

This means: US VCs are looking for investment opportunities outside of the US always. They scrape X, Linkedin, Github, Product Hunt and any place they can find companies growing fast doing exciting stuff.

These investors also place a premium on founders with strong backgrounds, such as previous entrepreneurial successes or experience in top-tier consulting firms or investment banking.

Notably, most U.S. VCs require these startups to be incorporated as Delaware C-Corps before investing, as it aligns with their legal and operational expectations.

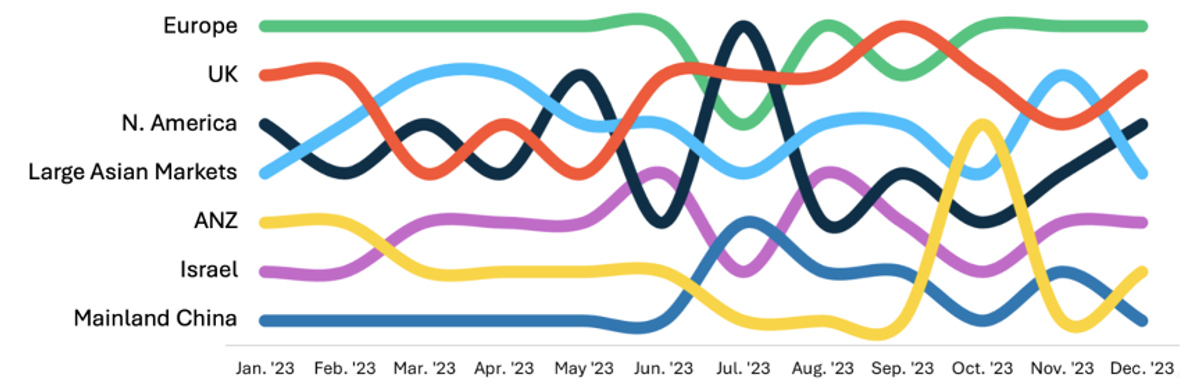

Outside of the US, main markets VCs scout for are👇

3. Startups Accepted into Top Accelerator Programs

Another pathway to U.S. funding is through acceptance into well-known accelerator programs like Y Combinator (YC), Techstars, or 500 Startups. These programs provide not only initial funding but also access to a vast network of mentors, investors, and other founders. For many startups, this is a crucial stepping stone to securing further investment from U.S. VCs.

For example, Razorpay, an Indian payment gateway startup, joined Y Combinator in 2014. This allowed the founders to refine their pitch, gain exposure to U.S. investors, and secure seed funding from YC and Matrix Partners. Similarly, Sendbird, a South Korean startup offering a messaging API, leveraged its participation in YC in 2013 to attract U.S. funding from Techstars and other investors. These accelerators validate startups’ potential, making them more attractive to VCs scouting for promising opportunities.

10 Examples of Born-Global Startups Securing U.S. Seed Funding

Here are some notable examples of born-global startups that secured seed funding from U.S. investors:

PrivateGPT/ZylonAI

Overview: Created by the CTO of Ontruck, PrivateGPT is an open-source tool allowing AI to operate offline, preserving data privacy.

Traction: The GitHub project went viral, amassing over 54,000 stars.

Funding: Raised $3.2 million in pre-seed funding from Felicis Ventures and others in 2024.