Hey everybody welcome back to the Product Market Fit Newsletter 🚀

My name is Guillermo Flor and I write this weekly newsletter to help founders, growth professionals and product people to grow & fund their companies.

So, the other day I met Andrew Gazdecki at Saastr and so I thought it would be cool to get some learnings from him.

Andrew has an incredible story, he built and sold his first app in College, and afterwards, also in College, he went on to build another Saas that we would later sell for + 20M and has since 2019 been building Acquire.com

But first,

Announcements:

My friend Maja Voje and I are going to host a community workshop which is part of the GTM Strategist Bootcamp.

It is a joint event for the ProductMarket Fit community, and more. During the session, you will learn.

💡It is impossible to discuss GTM Motions (predictable and scalable ways to acquire customers) before you have secured product market fit

GTM Actions - that you can use pre-product market fit to win traction - aka how to get your first 1000 users/100 customer .- spoiler: many things do not scale at this point, but it is ok because they get the job done and they have compound interests

We will analyze three “famous case studies” from Unicorns (Gusto- $9.5B valuation, Snyk- $3.3B valuation and Notion $10B valuation) 🦄 how they used GTM Actions and GTM Motions at different stages of their Product Market fit

Then, I will show you how - in two different examples - one simple product (product-led growth) and one complex enterprise (sales-led) we found the right GTM Motions to grow the businesses. Real cases from my consulting work because I want to show you how these decisions are made in practice. Some were made with $0 budget so you can easily implement them too.

👉SIGN UP HERE FOR THE SESSION 👈

Now, let’s get back to to the article👇

From College App to $500 Million transactions: How Andrew Gazdecki is building Acquire.com

From College entrepreneur to Acquire.com

Fifteen years ago, Andrew Gazdecki was just another college student with a big idea.

He bootstrapped a DIY mobile app builder right from his dorm room, scaling it to an astounding $10 million in revenue without a dime of outside funding.

But when he tried to sell his successful startup, he hit a brick wall.

"I spent two years emailing private equity firms and strategic buyers, completely clueless about the process," Andrew admits.

Inspiration for Acquire.com

After experiencing firsthand the difficulties of selling a business, Andrew identified a significant gap in the market. “

There are so many small points in the acquisition process that could be improved upon,” he noted.

“So I built Acquire.com to address that.”

His goal was to create a platform that would streamline the acquisition process for small business owners and help buyers find legitimate opportunities faster.

Business Model

Two Revenue Streams

Acquire.com operates on two main revenue streams:

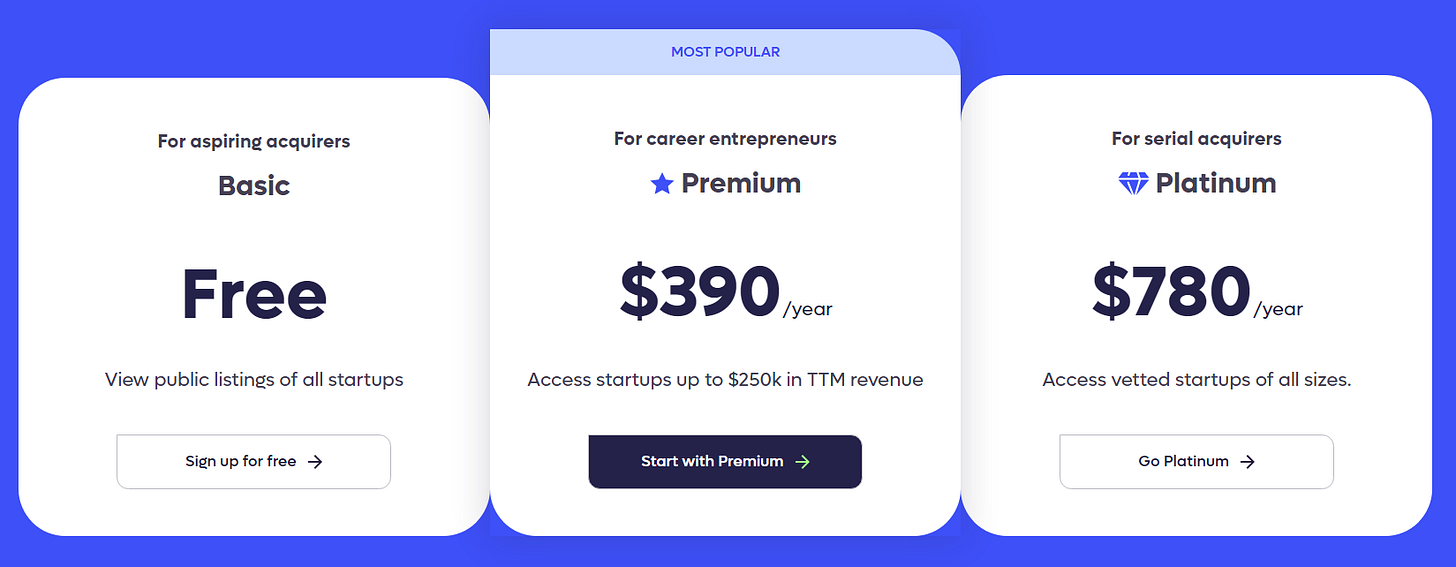

Buyer Subscriptions: Buyers pay between $400 to $800 per year to access detailed information about listed businesses, such as the owner's identity, financials, and presentations. This subscription model serves as a filter to separate serious buyers from casual browsers.

Seller Commissions: The platform charges a commission of 4-6% on successful transactions. The commission rate varies depending on the size of the business sold, ensuring fair compensation for the value provided.

Achieving $4 Million ARR with 5,000 Subscribers

The platform’s success is driven by a robust subscriber base. “We have about 5,000 subscribers, which puts us at around $4 million in run rate,” Andrew shared.

This growth was achieved through a comprehensive inbound marketing strategy, including SEO, social media, and content marketing.

“We create a lot of content—blogs, podcasts, webinars—that helps us attract and engage potential customers,” he added.

Scaling Up: Over 1,000 Transactions and $500M in Deal Volume

Automating the Acquisition Process

With over 1,000 transactions facilitated, Acquire.com has created a scalable solution to support business owners and buyers.

“When you have that many clients, you need to build an automated set of tools to serve all of them,” Andrew said.

The platform includes features like automated onboarding and a letter of intent builder, which allow transactions to progress quickly and efficiently.

This automation is critical for reducing friction in the acquisition process. “There’s a saying that ‘time kills deals,’” Andrew remarked.

“The more we can speed up the ability for a buyer and seller to meet and transact, the more deals we can facilitate.” This approach has enabled Acquire.com to close deals faster and support more transactions than traditional methods.

Bringing Liquidity to a Fragmented Market

Connecting High-Net-Worth Individuals with Small Businesses

A significant portion of Acquire.com’s buyers are high-net-worth individuals looking to enter entrepreneurship through acquisition.

Andrew highlighted the unique role his platform plays: “A lot of our buyers are VP of sales, VP of marketing, or even CEOs looking to buy an adjacent business. Identifying those people as buyers is really difficult because they don’t necessarily have a sign that says, ‘Hey, we buy companies.’”

Acquire.com simplifies this process by providing a centralized platform where these individuals can find businesses that fit their investment criteria. “We connect buyers and sellers in this market a lot easier than you would otherwise,” Andrew explained.

Navigating Regulatory Challenges

Operating in over 100 countries, Acquire.com faces complex regulatory environments. Andrew discussed the hurdles, particularly when dealing with international transactions: “If we were doing security sales and transacting corporations from, say, the United States to Spain, it’d be much more difficult. We’d have to get a lot more documents notarized and adhere to local laws much more strictly.”

To circumvent these challenges, Acquire.com primarily facilitates asset sales, which are simpler and less regulated compared to stock sales. “Typically, with our market being enterprise value of $5 million or less, those are almost always an asset sale because it’s more advantageous to the buyer,” Andrew noted.