🏛️ Europe's Godfather: How to build a generational $2B+ Fund from 0 (DETAILED)

From Spotify to Trade Republic: How Creandum turns 1 in 6 investments into unicorns

Merry Christmas everyone! 🎄

I hope you are having a great time with your family and wishing you all the best!

Today’s newsletter is a deep, clip-by-clip breakdown of my conversation with Staffan Helgesson, founder of Creandum. Early investor in Spotify($120B+), Klarna($45B+), Lovable($6.6B+), and Trade Republic($15B+).

One in six Creandum investments becomes a unicorn.

If you’re a founder, this is a look at how elite investors really think.

If you’re an investor, it’s a reality check on value-add, fund-building, and what actually scales.

Here’s what we’ll cover:

The real difference between a Founder & an Investor 🧠

How to start a successful fund

Is Venture Capital broken?

Founder mentality

How Creandum invested in Lovable 🔥

How to find the best founders before the rest of VCs

The reality of Venture Capital: unpredictability 🎲

What questions elite investors ask before writing a check

“Back founders so good that your value is marginal”

How Creandum saved Trade Republic when every VC walked away

How to make Europe great again 🇪🇺

How Creandum built an international fund from Stockholm 🇸🇪

How Staffan Helgesson built Creandum from scratch

The 4 types of Venture Capital

Let’s get into it 👇

Sponsor Product Market Fit & get your product in front of thousands of founders worldwide? Reach out to g@guillermoflor.com

Trending right now: The Data Room Template VCs love, 27 Most Promising AI Startup Pitch Decks Backed by Top Investors in 2025

1. The real difference between a Founder & an Investor 👇

Founders often respect other founders more than investors. That’s understandable. Founders build products. Investors write checks.

But building a great venture firm is not a passive activity.

It’s an entrepreneurial project with a different surface area.

A founder builds a company. An investor builds a system: access, judgment, trust, and outcomes, repeated over decades.

Both take risk.

Both operate with incomplete information.

Both are judged on long-term results, not early signals.

The real difference isn’t whether investors are founders. It’s what they’re founding.

The best investors aren’t operators who stopped building. They’re founders of an institution where selection is the product, and reputation is the moat.

2. How to start a succesful fund

Starting a fund is hardest when you have no brand, no track record, and no access.

At the beginning:

Founders DON’T KNOW YOU

Great deals already have competition

You can’t win on price, reputation, or platform

So early-stage fund building will come down to these two things:

1. Get your first real win as fast as possible

If you’re unknown, you can’t compete at Series A.

Your only viable move is to go earlier than everyone else.

At Pre-Seed / Seed:

Prices are low

Ownership is high

Founder quality matters more than the idea

This is how new funds earn the right to exist.

Creandum’s first proof points:

Edgeware in Fund I 🔥

iZettle and Spotify in Fund II 🔥

Those weren’t just good investments.

They were access unlocks — proof that changed how founders perceived the firm.

Early wins don’t just return capital.

They rewrite who takes your call.

2. Stay hungry after your first win

Staffan explained how the most dangerous moment for a fund isn’t when they miss. It’s early success.

A first big win will

validate your strategy,

but quietly kills your hunger.

Elite investors assume: they were early & lucky, not smart

Creandum treated every win as something that still had to be earned again.

3. Is Venture Capital Broken?

Every cycle, the same doubts return:

• Too much money

• Valuations too high

• Not enough exits

But venture isn’t broken. It’s behaving exactly as designed.

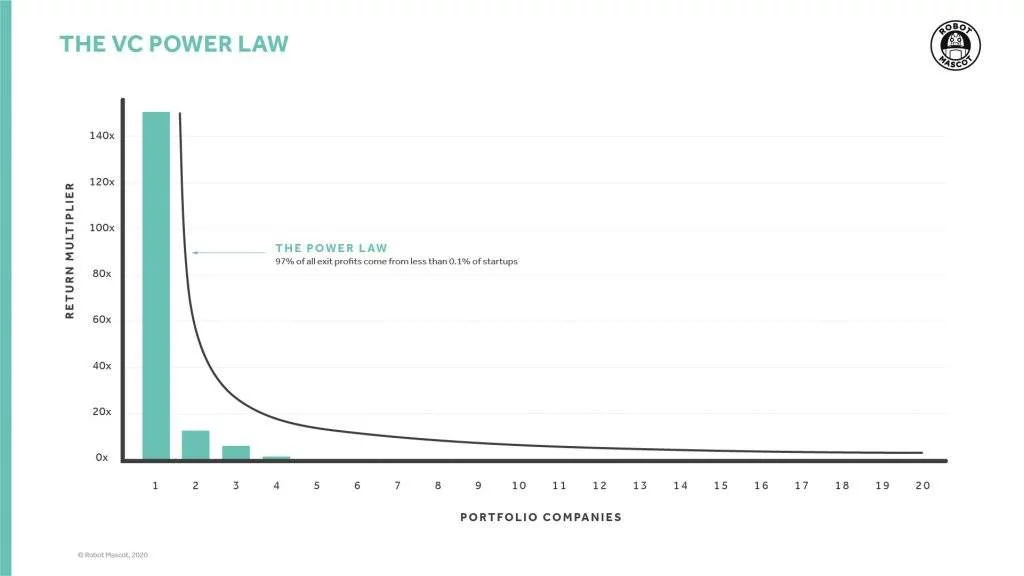

Venture is a power-law business. A few investors win. Most don’t.

When markets are strong, that reality is easy to ignore. When markets turn, it becomes impossible.

Capital doesn’t guarantee returns. Participation doesn’t either. Only edge does.

You need to be brutally honesty😅

Honesty about:

• why you get access

• why you win deals

• whether past success was skill or timing

There’s no macro solution for this.

The only way to win in venture is to be exceptional & to constantly question whether you still are.🔥

4. Founder mentality

I got obssessed with a Harry Stebbings interview some weeks ago. He said all great founders share these traits:

1. Superiority complex: they arrogantly believe they are better

2. Inferiority complex within themselves that they should be pushing harder, they should be pushing more

3. It's this deep masochism or sadism for themselves, which is deeply psychologically scaring for yourself but it drives you to be better and better

You can also see these traits in investors that have created some of the biggest brands in tech like Staffan Helgesson

Does that feel familiar?

5. How Creandum Invested in Lovable

Fredrik Cassel is one of the best investors in Europe.

He invested in Lovable, and he was Creandum’s first hire (started as an intern).

Here’s the crazy part: his “origin story” is basically a failed attempt to copy Google.

Before VC, Fredrik Cassel ran the largest search engine in the Nordics. One day his product lead tells him:

“Google launched AdWords. Should we build something similar?”

They built it. Complete disaster.

And that failure hardwired the mindset that shows up in every great investor:

- Product wins

- Speed wins

- Capital + geography matter more than people want to admit

If your product is inferior, the market won’t wait for you

In 2003 he meets Staffan Helgesson, who’s just starting Creandum, with one mission:

- back founders building tech that becomes global category leaders.

Fred joins as an intern.

20 years later, he’s a GP, still saying:

“I’m still an analyst at heart.”

This is the story of how he invested in Anton Osika 🔥

6. How to find the best founders before the rest of VCs

Creandum founder, Staffan Helgesson answers the Trillion Dollar Question: How to find the best founders in the world before every VC is after them 😅 👇

It’s how to see founders before everyone agrees they’re great.

Staffan is clear:

You have to go early. And you need to back the founder, not they idea.

At the earliest stages, the company barely exists. So the only thing worth underwriting is the individual.

Early investing isn’t about what the company does. It’s about who the founder is.

The best early investors filter for:

rate of learning

clarity of thought

intensity and ambition

ability to attract exceptional people

Products change. Markets change.

Founders don’t.

As you move later, the job changes.

At later stages, selection becomes more complex:

the market matters

the product matters

execution history matters

competitive dynamics matter

But by then, you’re no longer discovering founders —

you’re competing for them.

That’s why the best firms bias early:

not because it’s safer,

but because it’s the only moment when founder quality is still the main signal.

7. The reality of Venture Capita: Unpredictability

The reality of VC: It's unpredictable.

Creandum's fund 1 was good: One IPO

Fund 2 was amazing: Spotify

Fund 3: 150M euros, 33 Deals. And after investing, it felt very bad.

After 5-7 years they had 7 unicorns 🤯

Sometimes you know you have great companies and some times you don't.

Venture Capital is unpredictable

8. What questions do elite investors ask before writing a check?

Staffan Helgesson explained how the real diligence happens before writing checks. Its answering these questions about the founder.

Are they unreasonably ambitious?

Not “big company” ambitious. World impact ambitious.If the ambition is capped, the outcome will be too.

Can they act and talk intelligently about what they’re building?

Not buzzwords. Understanding:what’s broken today

what becomes possible

why this team wins

If they can’t explain the future clearly, they won’t build it.

Would I work for this founder?

You need to know whether exceptional people will follow them. iPod-scale companies are built by teams that choose the founder, not the job.

When there’s a mismatch between the ambition of the company and the founder’s instincts, it shows early. Founder suitability is key.

9. “Back founders so good that your value is marginal”

As Staffan Helgesson puts it, the best founders don’t need saving.

They can execute, recruit, and adapt on their own.

The investor’s job is to help from the side, and stay out of the way otherwise.

There’s a simple reason: value-add doesn’t scale across 40–50 companies.

What does scale is: backing founders strong enough to win without you.

That’s what “marginal value” really means:

timely help when it matters, restraint when it doesn’t.

10. How Creandum saved Trade Republic when every VC walked away

“Value-add” in venture usually refers to platforms, intros, support… But in practice its very different.

Staffan Helgesson, early investor in Trade Republic, explained that the problem wasn’t the founder or the product. It was the cap table: The seed investor owned a majority, which made the company uninvestable.

Most funds passed. Creandum didn’t.

They spent time and effort convincing the seed investor to dilute to ~25%, with a simple argument: owning less of something much bigger usually leads to a better outcome.

That changed history. Trade Republic went on to become a $14B+ company.

The same instinct showed up earlier with Spotify in 2008.

Every VC loved the team and the product, but most investors said, “Come back once the labels are signed.” Instead, Creandum stayed close, stepping in and helping only when the last hard piece needed to be solved.

That’s real value-add: finding the one thing holding a great company back, and fixing it when others pass.

11. How to Make Europe Great Again

Europe still lacks maturity as a tech ecosystem. But companies like Spotify, Lovable, and Klarna matter for one reason: they create precedent.

They show founders what’s possible, and how to do it from Europe.

The raw ingredients are already here. Europe has a fantastic talent pool of ~500 million people.

We’re behind the US today, but the potential is obvious.

What actually needs to change:

Less regulation – faster company building, fewer blockers

Import top talent – make Europe magnetic, not restrictive

Lower taxes – reward risk-taking

A true EU equivalent of Delaware – simple, standardised company formation (EU INC)

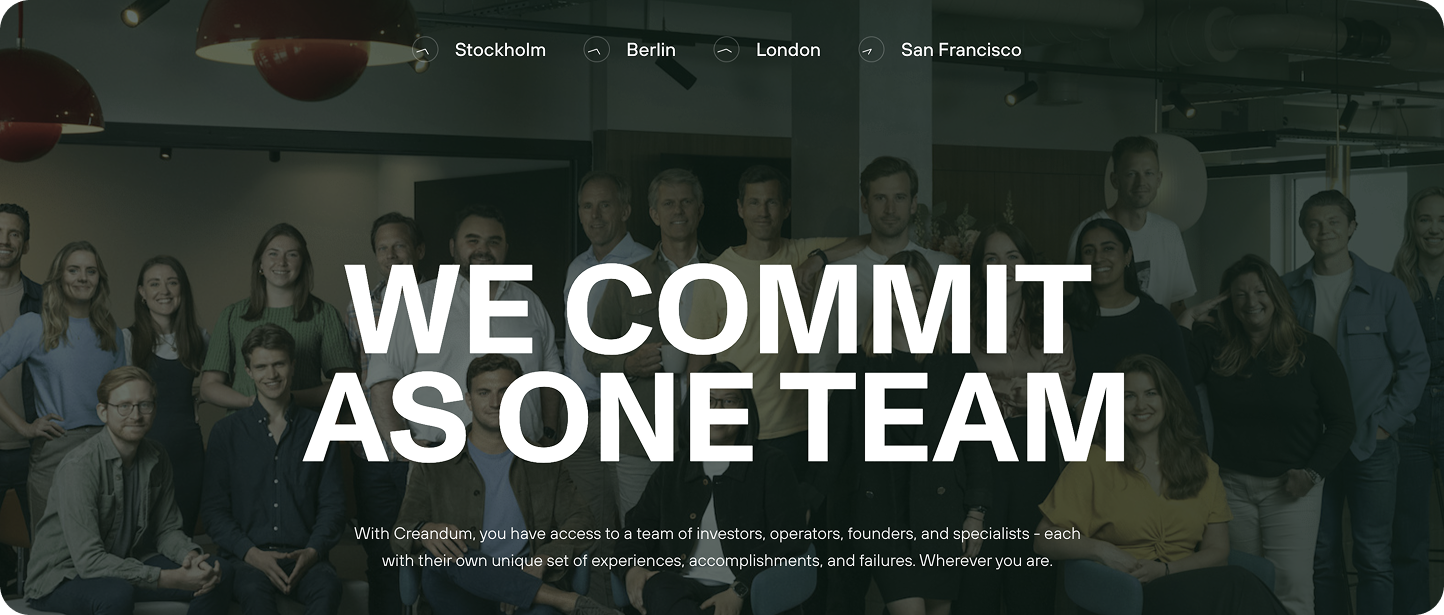

12. How Creandum built an international successful fund from Stockholm 🇸🇪

Creandum scaled in an unconventional order? What they did:

Start local: launched the first fund in Stockholm, building early conviction and wins in a market they understood deeply.

Dominate the region: expanded across the Nordics, where trust and pattern recognition compounded.

Go global the hard way: instead of London or Germany, they opened in San Francisco. If you can compete there, you can compete anywhere.

Then open London: by the time they opened London, they already had international credibility.

The lesson: Depth first. Credibility next. Authority follows.

13. How Staffan Helgesson built Creandum from nothing (and how you should do it too)

Staffan Helgesson realised early that he couldn’t build a great venture firm alone.

Not because of workload, but because venture doesn’t compound through effort, it compounds through judgment. And judgment improves when it’s shared by peers, not dictated from the top.

So he made three deliberate choices.

1) HIRE SENIOR PARTNERS EARLY, not employees.

Instead of building a solo GP model and adding “support” later as they scaled, Staffan planned ahead:

He brought in senior people early with the intention that they would become long-term partners.

This defines exactly how your fund will operate:

Culture is set early

Decision-making norms form quickly

Power dynamics are hard to undo later

Team. It was built as a partnership from day one.

2) Back young talent and let them grow into partners

At the same time, Creandum invested in young talent early.

One of their first interns is still at the firm 23 years later. Now a Partner.

That same person, Fredrik Cassel, later went on to lead Creandum’s investment in Lovable 🤯

This isn’t about loyalty for loyalty’s sake. It’s about compounding judgment. They develop investors over decades.

3) Operate like Benchmark: ALL partners share carry

This is the most important design decision. At Benchmark, all partners share the same carry:

No individual deal attribution

No internal scorecards

No hierarchy of ownership

Everyone wins only if the firm wins.

Why this works:

No internal competition

Partners don’t hoard deals or optimise for personal credit.Better decision quality

Bad deals get challenged honestly. There’s no incentive to push something just to “own” it.Real collaboration

Help is given freely because success is shared.Long-term thinking

Reputation and outcomes over decades matter more than one fund’s optics.

Most VC firms say they value teamwork.

Benchmark hard-codes teamwork into incentives.

The real lesson

A flat partnership with shared carry doesn’t just attract great people. It forces aligned behaviour.

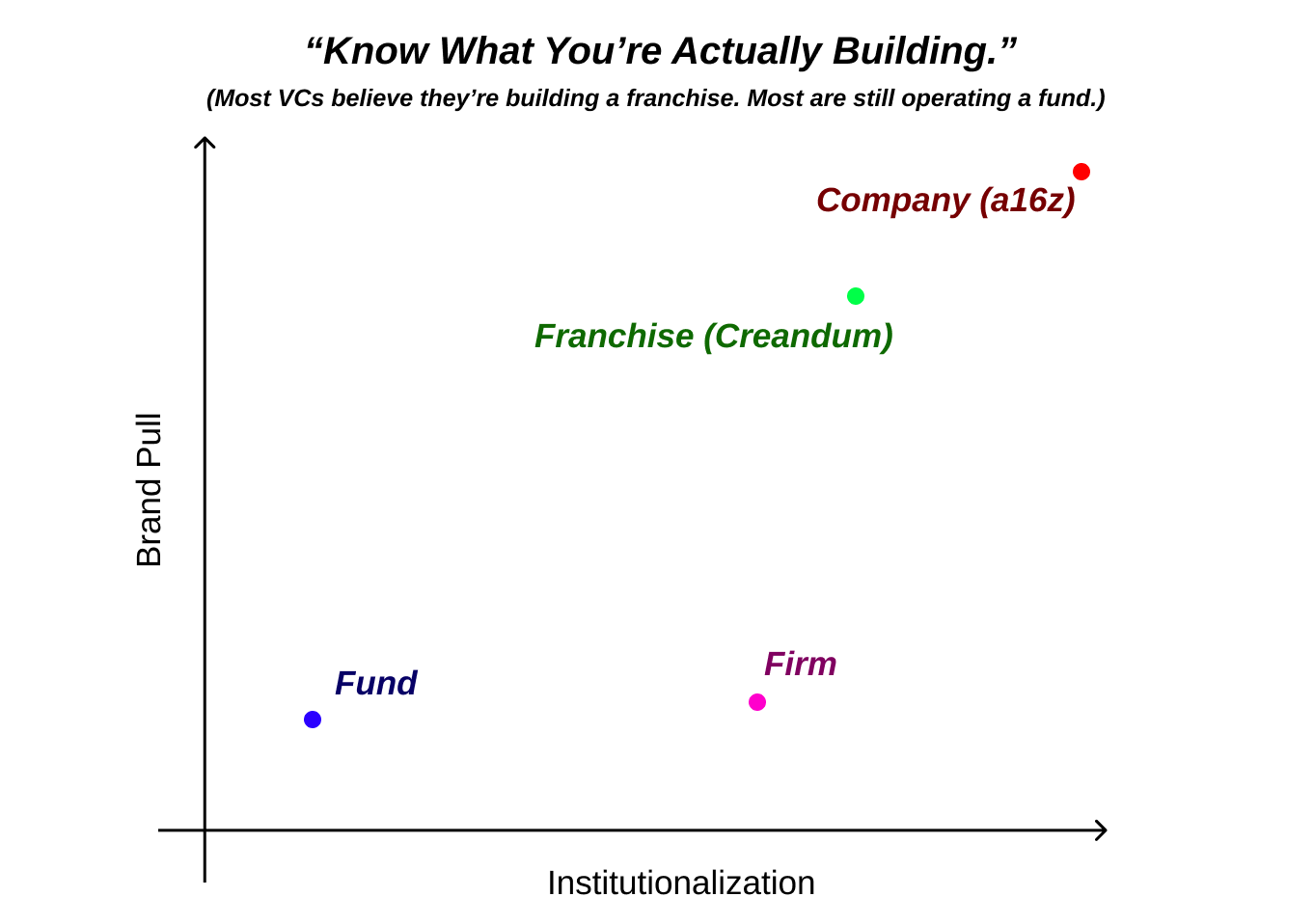

14. The 4 types of Venture Capital:

(Will go into more details about this in another newsletter)

1) Funds

A single vehicle (or two) run by a small team.

Raise. Invest. Return capital. Maybe raise again, maybe not.

Outcome depends heavily on a few individuals.

2) Firms

What it is:

A repeatable organisation with multiple partners and a process.

Able to raise fund after fund because it’s institutional, not individual.

Durability > any one fund.

3) Franchises (Creandum)

The name itself is an asset.

Founders want the firm, not just a specific partner or fund.

Compounds over time.

4) Companies (Andreessen Horowitz)

A VC built like a full-stack company.

Multiple teams, platforms, and products around the core investing engine.

Operating leverage at scale.

Hope this was valuable! I’d appreaciate a share if it was!

Best,

Guillermo

Founder vs Investor: what’s really different?

1) What’s the real difference between a founder and an investor?

A founder builds a company; an investor builds a repeatable system for access, judgment, trust, and outcomes over decades. The best investors are “founders of an institution” where selection is the product and reputation becomes the moat.

2) Do great investors need to have been founders/operators?

Not necessarily. The edge isn’t “I once ran a company,” it’s “I can consistently identify and win access to exceptional founders early,” and then compound that advantage across cycles.

3) Why do founders often respect other founders more than investors?

Because the work looks asymmetric: building vs writing checks. But building a top firm is not passive—it’s entrepreneurial, high-risk, and judged on long-term results with incomplete information.

Starting a VC fund: the playbook when you have no brand

4) How do you start a successful VC fund with no track record?

You go earlier than everyone else. Pre-seed/seed is where prices are lower, ownership is higher, and founder quality outweighs the idea—so a new fund can earn its “right to exist” through an early proof-point.

5) Why can’t new funds compete at Series A?

Because competition is brutal and you can’t win on brand, platform, or signaling. Early-stage is where speed, conviction, and founder relationships can still beat reputation.

6) What’s the fastest way for a new fund to build credibility?

Get one real win that changes founder perception—because returns don’t just bring LP capital, they unlock access. A first breakout deal rewrites who takes your call.

7) What’s the most dangerous moment for a new fund?

Early success. It validates your strategy, but can quietly kill hunger. Elite investors treat wins as partly timing/luck—and assume they must re-earn the edge every cycle.

Is venture capital broken? Power laws and brutal honesty

8) Is venture capital broken right now?

Venture isn’t “broken”—it’s a power-law business behaving as designed: a few funds drive most returns, most don’t. In good markets that’s easy to ignore; in downturns it becomes impossible to hide.

9) What is a power law in venture capital?

A small number of investments (and funds) generate a disproportionate share of outcomes. That means “average” decision-making and “average” access often produce below-average results.

10) Why do so many VCs underperform even with lots of capital?

Because money doesn’t create edge. Access, selection, pricing/ownership, and judgment under uncertainty do—and those advantages are rare and hard to sustain.

11) What does “brutal honesty” mean for VC performance?

Be honest about why you get access, why you win deals, and whether past wins were skill or timing. There’s no macro fix—only exceptional execution and constant self-auditing.

Founder mentality: what elite people share

12) What traits define the “founder mentality” you described?

A volatile mix: (1) superiority complex (“I can win”), (2) internal inferiority pressure (“I’m not doing enough”), and (3) a willingness to suffer for progress. That cocktail shows up in many top founders—and in the investors who build enduring firms.

13) Can investors have a founder mentality too?

Yes—especially those building a firm from scratch. Fund-building is its own kind of company-building: long feedback loops, reputation risk, and compounding through cycles.

Finding the best founders before everyone else

14) How do top VCs find the best founders before other investors?

They bias early—before consensus forms. At the earliest stage, the “company” barely exists, so underwriting the founder is the only signal with enough predictive power.

15) What do elite seed investors look for in founders?

Rate of learning, clarity of thought, intensity/ambition, and the ability to attract exceptional people. Products and markets change; founder quality is more persistent.

16) Why does early-stage investing focus more on founders than ideas?

Because the first version is usually wrong. If the founder can learn, recruit, and adapt faster than reality changes, the idea can evolve into something huge.

17) Why is later-stage investing a different job?

Because selection expands: market structure, competitive dynamics, product proof, execution history, and go-to-market matter more. You’re no longer “discovering” founders—you’re competing for them.

Unpredictability: why VC feels random (even when it isn’t)

18) Why does venture capital feel so unpredictable?

Because the time horizon is long, information is incomplete, and outcomes cluster late. A portfolio can feel “bad” for years and then suddenly produce multiple outliers.

19) Can you know early if a fund will be great?

Sometimes—but often not. Many top portfolios look messy mid-flight because the winners don’t show up linearly; they show up when scale, timing, and distribution click.

Diligence: the questions elite investors ask before writing a check

20) What questions do elite investors ask before investing?

Three founder-centric ones:

Are they unreasonably ambitious (world-impact ambitious)?

Can they explain the future clearly (what’s broken, what becomes possible, why them)?

Would exceptional people work for them?

21) Why is “Would I work for this founder?” such a strong filter?

Because category-defining companies are built by teams that choose the founder—not the job title. If top talent won’t follow, the ceiling drops fast.

22) What does “founder suitability” mean?

A fit between the founder’s instincts and the scale of the ambition. When ambition and personal operating style mismatch, it shows early—in recruiting, speed, and decision quality.

“Value-add” reality: why the best founders make investors marginal

23) What does “Back founders so good your value is marginal” actually mean?

It means the founder can execute, recruit, and adapt without being “saved.” Your job becomes high-leverage help at key moments—and restraint everywhere else.

24) Why doesn’t VC value-add scale across 40–50 companies?

Because attention is finite. “Platform” can help at the margins, but the scalable strategy is selection: backing founders who win even when you’re not in the room.

The Trade Republic lesson: when “value-add” is one hard fix

25) What made Trade Republic “uninvestable” when other VCs walked away?

The cap table—specifically, a seed investor owning too much, which can block future rounds and distort incentives. Fixing cap-table structure can matter more than product polish.

26) How do you fix a broken cap table without killing the company?

You align incentives: convince early holders that owning less of something much bigger often beats owning most of something that can’t raise. The best fixes are surgical and relationship-heavy.

27) What’s the most underrated form of VC value-add?

Solving the one bottleneck that prevents a great company from compounding—cap table, hiring, distribution, regulatory unlock, or a key partnership—when others pass.

Europe: what needs to change for more Spotifys

28) How can Europe create more global tech winners?

Precedent matters: breakout companies expand ambition and teach playbooks. Practical levers include faster company-building, attracting top talent, rewarding risk-taking, and making incorporation simpler across borders.

29) What is “EU Inc” and why do founders want it?

It’s the idea of a standardized, founder-friendly European incorporation framework (a “Delaware equivalent”) so building across EU markets is less legally fragmented and slower.

Building an international VC from Stockholm

30) How did Creandum build an international fund from Stockholm?

By compounding credibility in the right order: depth locally → dominate the region → compete globally (even in SF) → then expand further once the brand travels.

31) Why expand to San Francisco before London or Germany?

Because it’s the toughest arena. If you can win access and reputation there, it upgrades your global credibility everywhere else.

32) How do you turn a VC into a durable franchise (not just a fund)?

Make the name an asset founders want—bigger than any one partner. That requires consistent selection, trust, and behavior that compounds over decades.

The 4 types of venture capital (and why most people mislabel themselves)

33) What are the four types of VC you described?

Funds: one vehicle, small team, outcome tied to individuals

Firms: repeatable organization that raises repeatedly

Franchises: brand is the asset founders seek

Companies: full-stack VC with platforms/products around investing

34) Why does it matter which type of VC you’re building?

Because it changes everything: hiring, governance, carry structure, platform spend, partner incentives, and what “scale” even means.

35) Why do most VCs think they’re building a franchise—but aren’t?

Because a franchise requires founder pull for the brand, not just one partner’s network. If deal flow collapses when a single person leaves, it’s not a franchise.