Creandum fundraising Toolbox, from Seed to Series A

The full fundraising toolbox for founders by Creandum, on of the leading venture capital funds in Europe

Hey everybody, Welcome to Product Market Fit 🚀🚀

For today’s newsletter, I curated Creandum’s most famous fundraising resources:

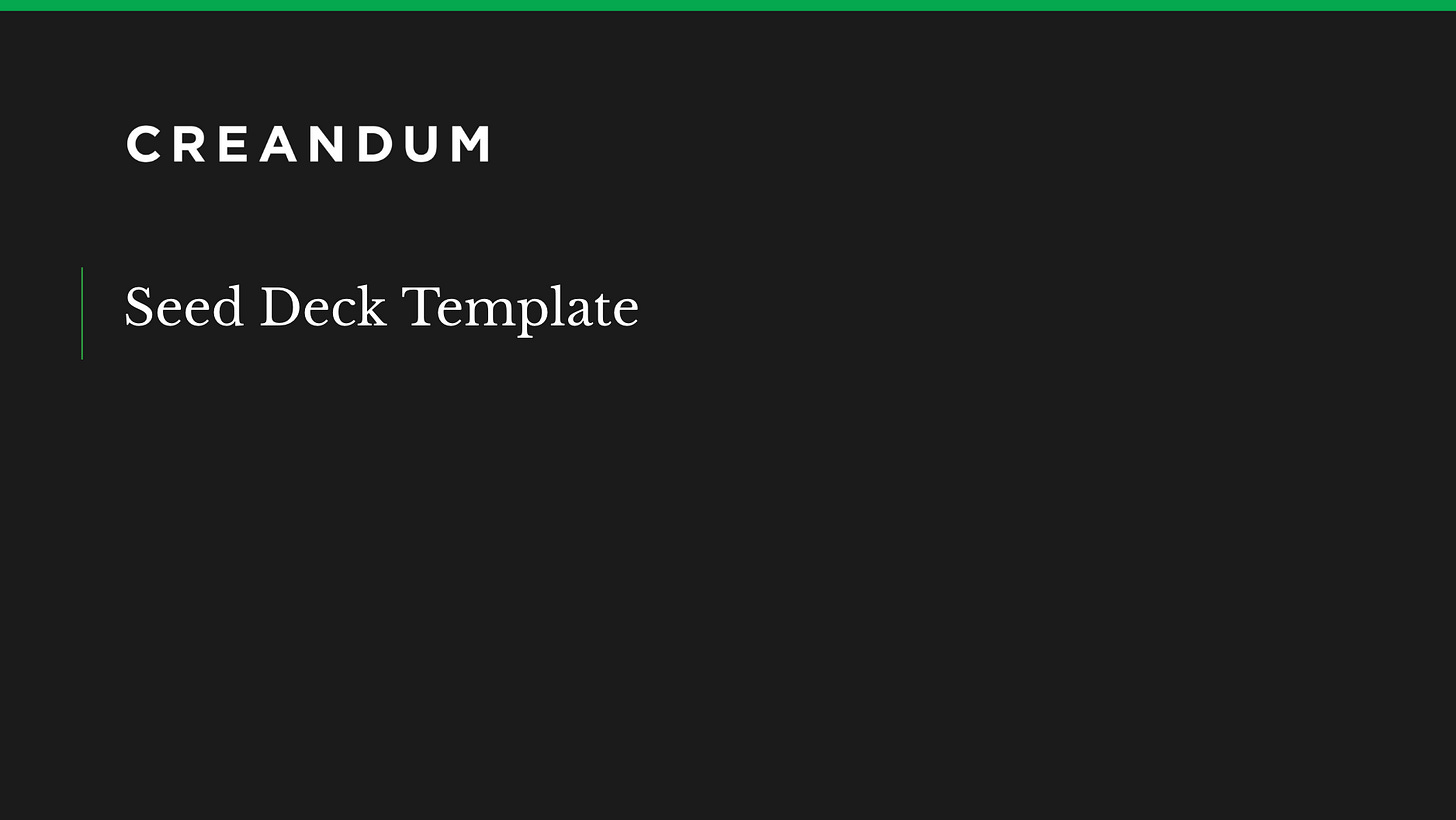

Creandum Seed Deck Template (PPT)

Creandum’s Seed Deck Template is a clear, structured guide to help founders tell a compelling story and raise their first round. It covers all the essentials: a sharp exec summary, clear problem-solution framing, product deep dive with visuals, credible market sizing, differentiated positioning vs. competitors, early metrics or pipeline, strong team highlights, and a forward-looking vision. It’s designed to help you stand out, even if you're pre-revenue, by showing clarity, ambition, and execution potential in 15–20 well-crafted slides.

Creandum Series A Deck Template

If you’re raising a Series A, use Creandum’s deck template, it’s one of the best out there. It shows you exactly what VCs want to see: problem, product, traction, market size, vision, all in a tight, clear structure. It also reminds you to make it look good and keep your numbers fresh.

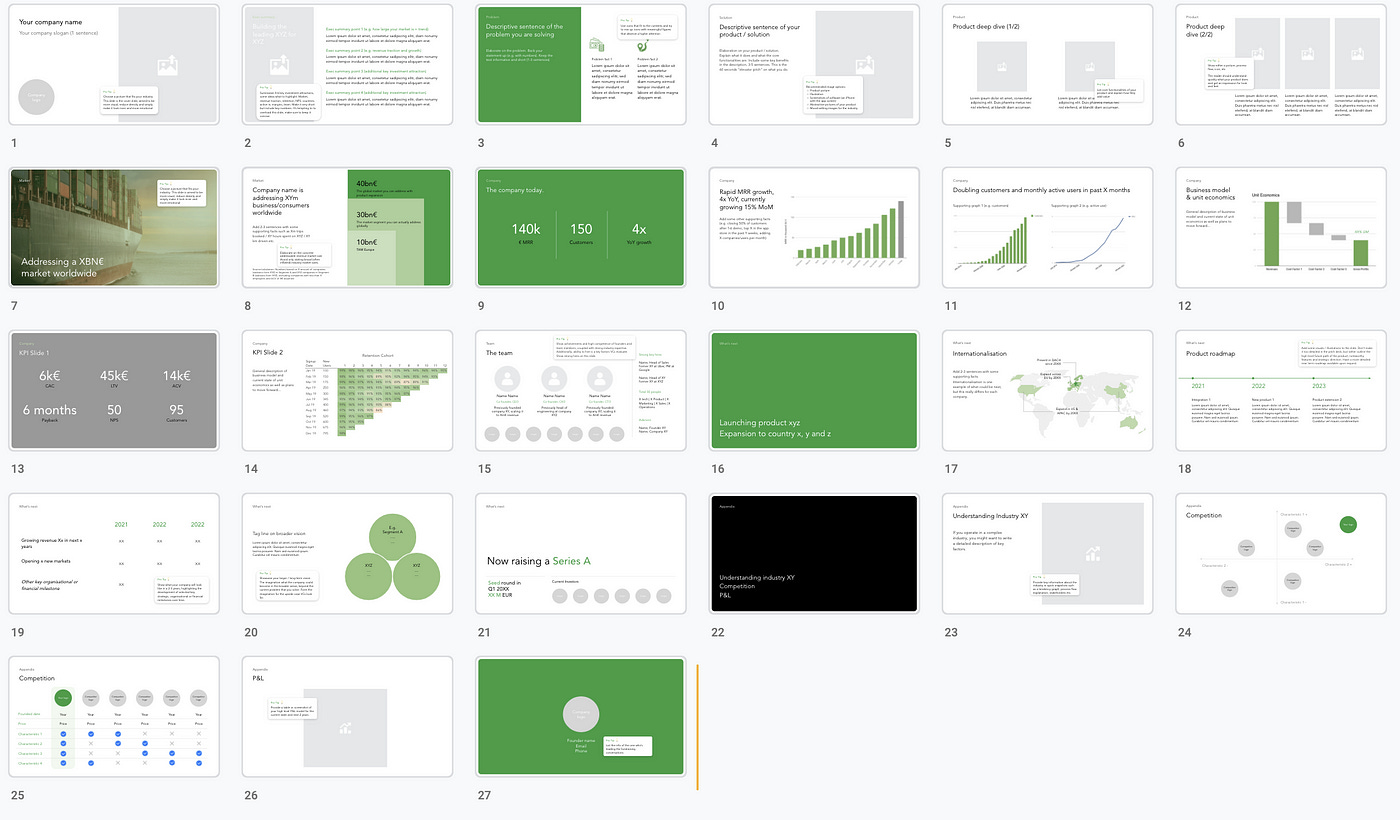

Creandum Data Room Template

Creandum’s Data Room Template gives you a clear checklist of what to include when you're raising a Seed or Series A. It covers the essentials investors want to review before committing: your pitch deck, detailed team profiles, a product overview and roadmap, core metrics (like growth, retention, and CAC), key customer insights or case studies, and a solid financial plan with assumptions.

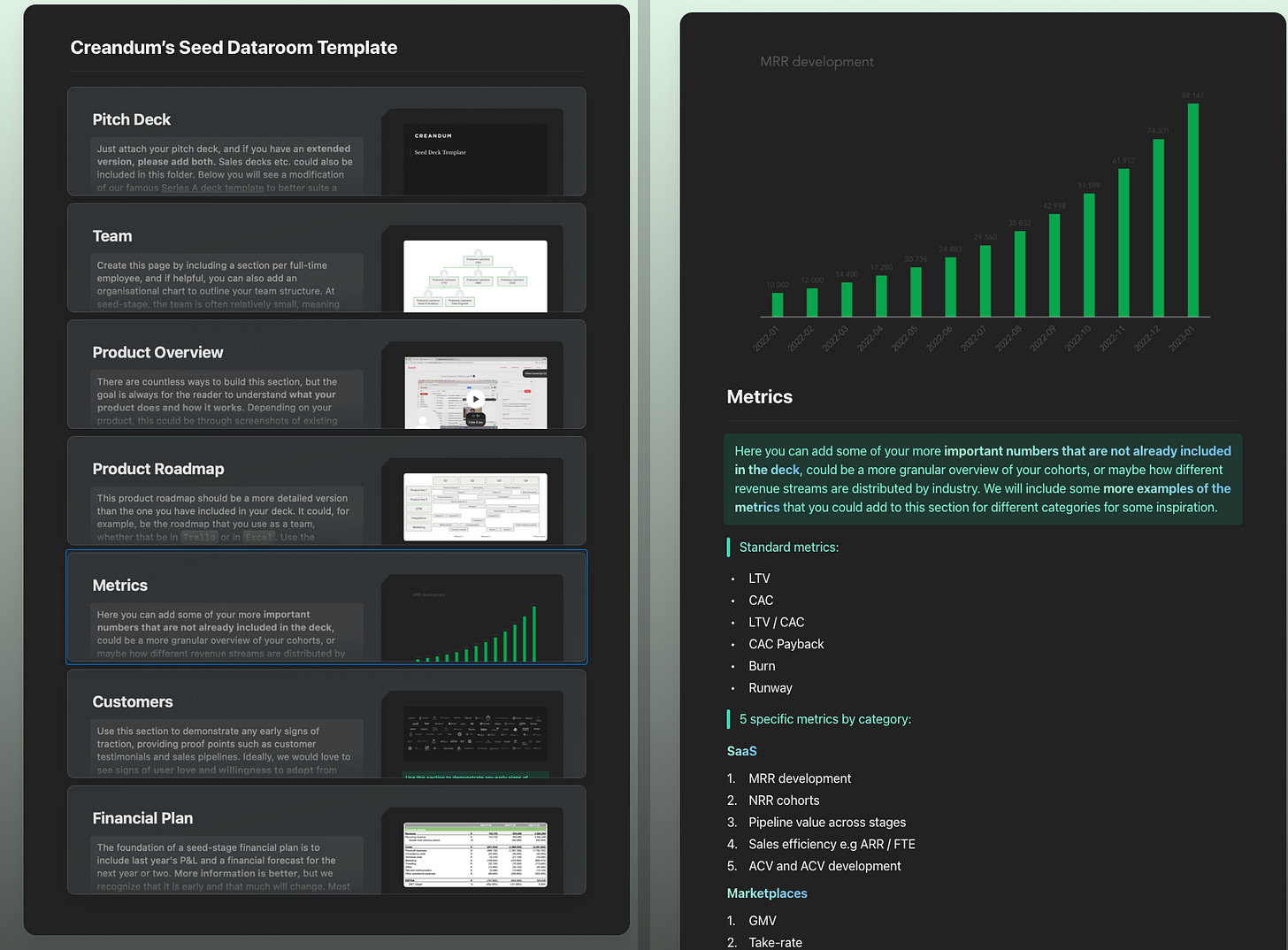

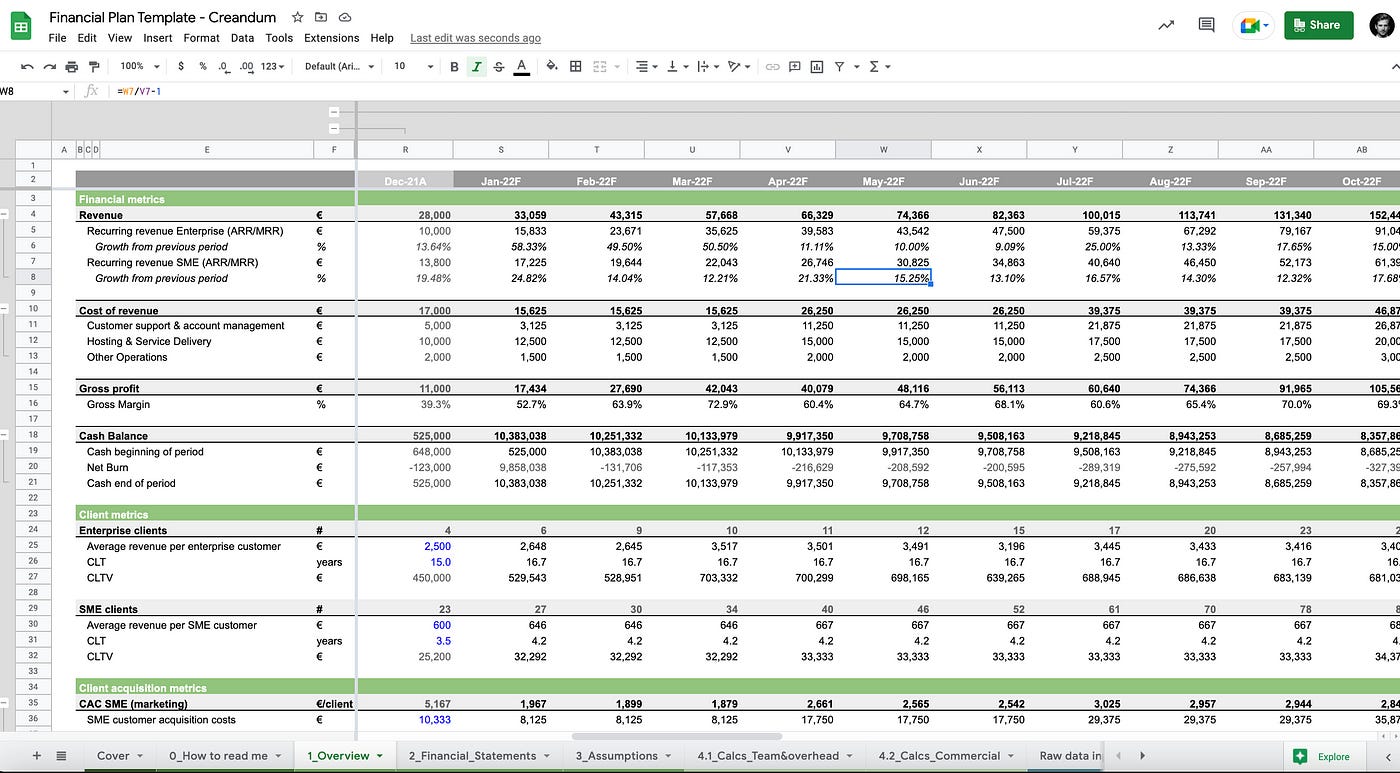

Creandum Financial Plan Model

If you're raising a round, Creandum’s financial model template is a must-have. It’s not just a spreadsheet, it’s your second pitch.

VCs will dig into your assumptions, so this template helps you show how your business actually works: growth drivers, KPIs, financials, and transparency. It’s clean, clear, and built for storytelling.

Creandum is one of Europe’s most successful early-stage venture capital firms.

With a portfolio that includes Spotify (IPO), Klarna (Europe’s highest-valued private fintech), and Depop (acquired by Etsy for $1.6B), Creandum has consistently backed category-defining companies from seed.

Based in Stockholm, Berlin, and London, the firm has built a reputation for spotting breakout talent early, often before others are paying attention.

With over $1B in assets under management and a track record that rivals top global firms, Creandum is a one of the leading firms in European venture.

BTW, I just wrote an article for a16z Speedrun’s Newsletter about why every founder should be in the US at least 3 months a year. Click in the picture below to check it out!

In this newsletter I curated Creandum’s most famous fundraising resources:

Creandum Seed Deck Template (PPT)

Creandum Series A Deck Template

Creandum Data Room Template

Creandum Financial Plan Model