Hi everybody welcome back to another week of Product Market Fit 🚀🚀

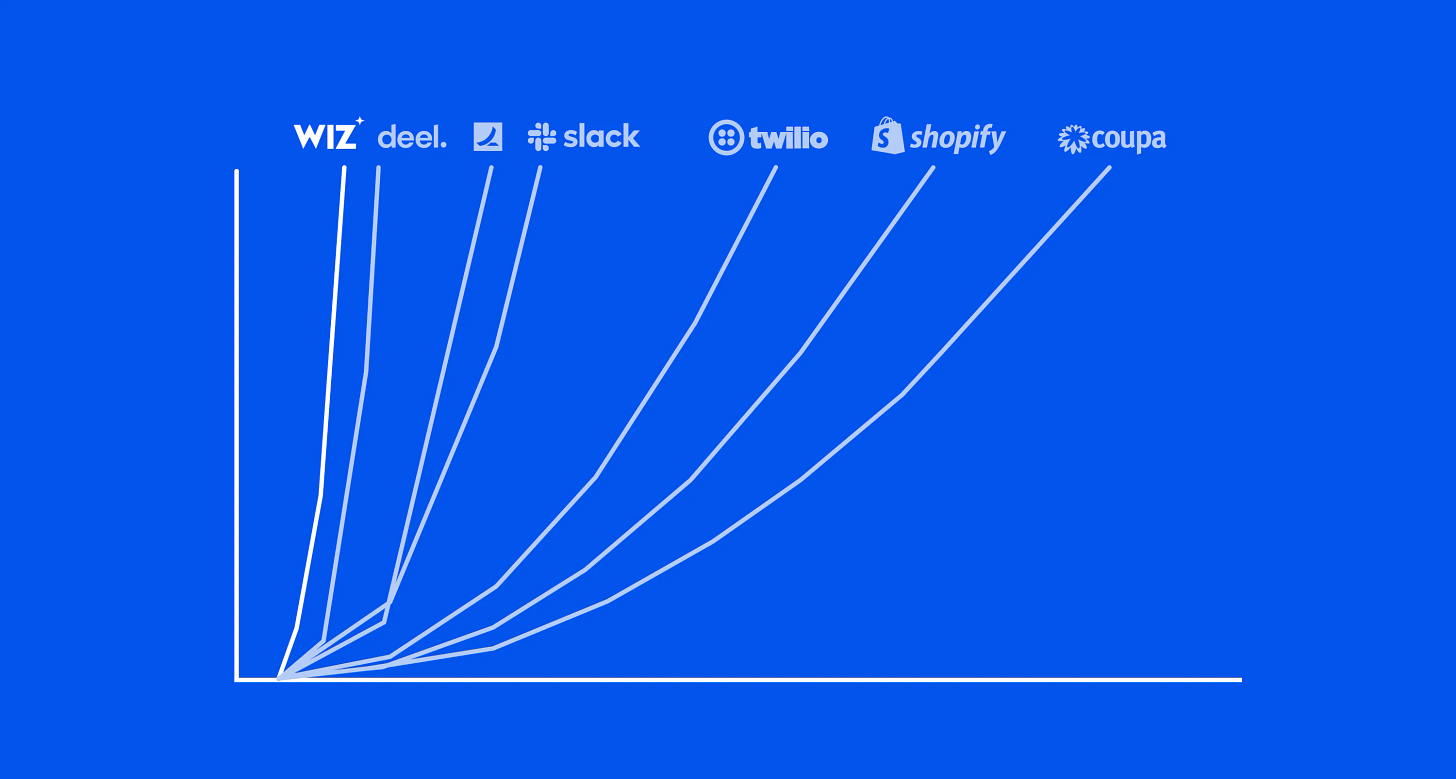

Today I wanted to do a quick deep dive into Wiz, a startup that became the fastest growing tech company ever 📈

But first, some nice deep beats in the Dolomites ⛰️

How Wiz grew from $0 to $100M ARR in just 18 months becoming the fastest company ever to do so

So, first of all, congratulations to the founders for this. It’s an unbelievable feat and there is so much we can learn from it.

Now, this is not something your everyday startup founder can do. Let’s look at how they did it 👇

The team 🥇

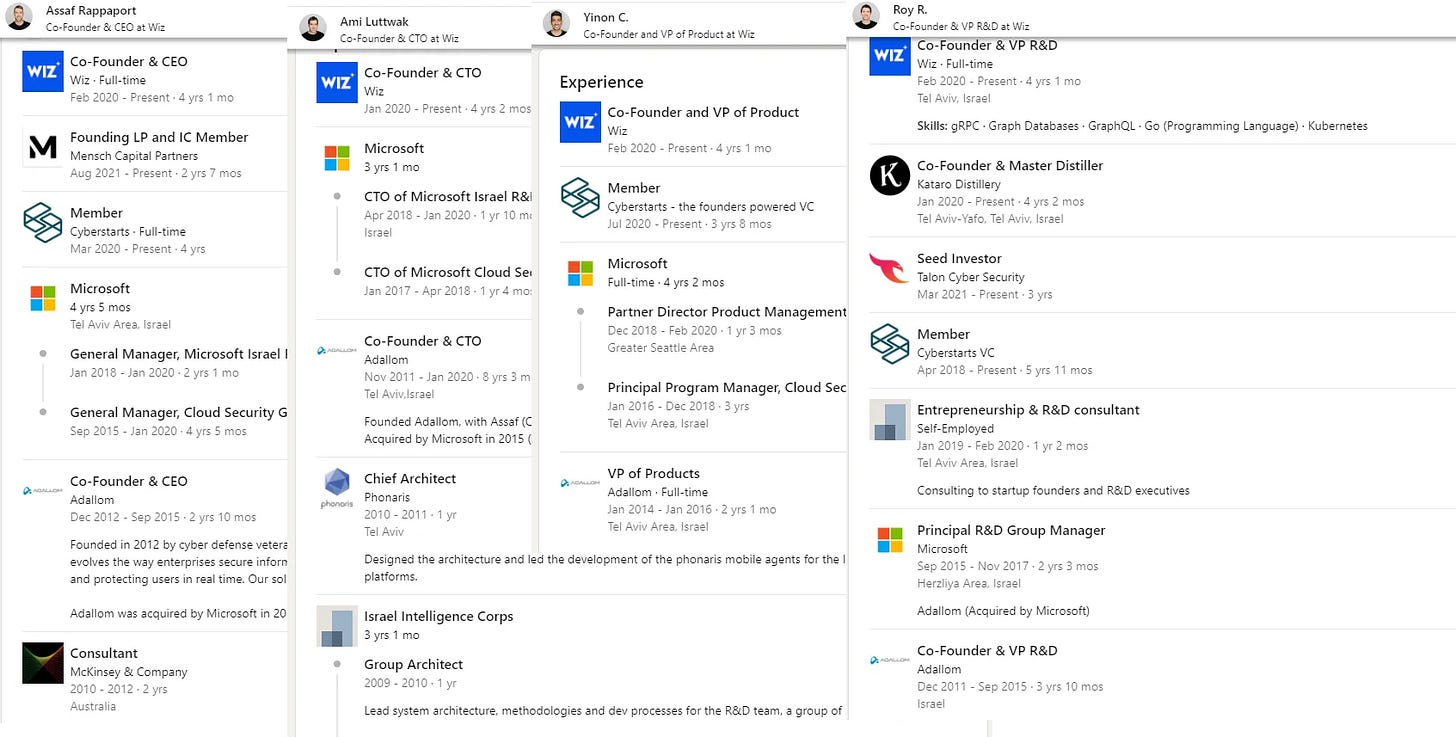

Wiz had a world class founding team

All four founders:

Had market fit: they knew the cybersecurity market and problems in depth.

They had been working on it for at least 10 years

Had built before a big successful company in the cyber security industry

Had a great investor network internationally

Had access to worlds biggest corporations to sell their product

Now, let’s dig deeper…

All four founders had an incredible resume having built a previous successful cybersecurity company that was acquired by Microsoft for $320 million in July 2015. Not a bad start.

With Adallom they raised $4.5 million (~$5.51 million in 2022) in Series A funding from Sequoia Capital and Zohar Zisapel and later a $15 million in series B funding led by Index Ventures with contributions from Sequoia Capital Israel.

Not bad at all.

Check these guys out ⬇️

Now, still how did they grow so fast?

The funding 💵

1. $100M Series A

Wiz raised a $100M Series A in just 9 months after starting the company - Dec 2021

Valuation: 500M

You can see how this is not your typical startup.

The round was filled by:

Sequoia

Insight Partners

Index Ventures

Cyberstarts

Cerca Partners

What did they have at this point?

1. Huge growing market:

The information security and risk management market was growing at a compound annual growth rate of 8.2%, becoming a $207.7 billion market by 2024.

2. Customers:

Supposedly 30 corporate customers, some of the several of the U.S.’ largest companies by revenue as clients; it named DocuSign as one notable customer.

3. Metrics:

Around $2M ARR

When asked why Index went so big on Wiz’s first funding round, Shah pointed out that the average startup typically takes between 35 and 40 months to generate $2 million in annual revenue. “It’s taken Wiz less than six,” Shah says. “It’s a completely different slope.”

4. Product:

Wiz’s claimed that it can onboard clients in minutes, providing corporate IT security teams with a singular platform that allows them to scan an entire cloud environment for vulnerabilities, risks and identity issues, as opposed to using multiple tools.

5. Team

30 Employees at this point

For many startups this achievement would be a great success but for Wiz was just a starting point.

2. $120M Series B

Wiz raised $120M Series B only 5 months after raising the series A - May 25, 2021

Valuation: 1.7B

Investors:

It hard to find the exact metrics for the company at this point but the company was growing in revenue and already had + 80 employees.

3. Another $250M in Series C 11 months after series A - October 2021

Valuation: $6B

Investors:

Sequoia Capital

Salesforce

Insight Partners

Index Ventures

Greenoaks

Cyberstarts

and… 18 months since their series A wiz gets to $100M ARR

The strategy

Enterprise clients

Wiz protects the world’s largest and fastest growing organizations, including more than 25 percent of the Fortune 100. Companies like Avery Dennison, BMW, Colgate-Palmolive, Costco, Chipotle, EA, LVMH, Mars, Salesforce, Slack, and hundreds more trust us to help them rapidly identify and remove critical cloud risks.

Compound Startup

Wiz was built as a compound startup from the very beginning.

What does he mean by a compound startup? Well, instead of building a point product for cloud infra security, Wiz set out from the get-go to build a platform tackling 4 distinct dimensions:

1️. Workload security

2️. Posture management

3️. Data security

4️. Entitlements management

This — coupled with easy deployment due to being “agentless” — has enabled Wiz to land & expand customers at a remarkable velocity.

The sales and CS teams at Wiz can enter with any of the 4 products, depending on customer need, and expand to the others.

Especially during this macroeconomic climate, customers want to rationalize spend and are tired of point products (point product = a product that provides a solution to a single problem rather than addressing all the requirements that might otherwise be met with a multipurpose or multiservice product).

Build to scale and thinking huge

You don’t build a feature if you can’t scale to a hundred millions users,” says Luttwak.

“First of all, to be the fastest company to $100 million ARR is not a goal [we had]. And it’s not, by the way, a guarantee for future success. It’s a milestone. It’s a small milestone in a long journey for us,”

Hands on culture

From the CEO, to the product, to the CTO … it’s a hands-on culture,” he says. “We don’t just manage, we actually do.”

Customer centric

I would tell you that the one thing that was important for us from the get-go was that it was all about the customer, and from day one we were focusing on the thought leaders of the security world and cloud security,”

Know more👇